The Christopher Nolan bio-pic Oppenheimer was a rare box office hit.

Stock market vet Ian Wyatt is betting that “Oppenheimer AI” will make an even bigger impact on our investment returns, which is why it is his #1 trade for the year.

The Teaser

It's a badly kept secret that artificial intelligence is sparking huge energy shortages.

Stealthy and wealthy appear to be Ian Wyatt's motto. He's been an individual investor and internet entrepreneur since people had AOL accounts, yet he's flown under the Green Bull's radar…until now.

Interestingly, we have reviewed another Oppenheimer-related teaser in the past, as well as Bill Gates’ $4 billion “Natrium” AI Bet, more recently.

Ian's “Oppenheimer Project” is a combination of both of these.

An artificial intelligence (AI) angle, with next-generation energy stock picks that will power AI data centers around the world.

Why energy?

Simply put, it's the only thing that could stop AI from reaching Terminator-levels of consciousness.

We have covered at length how AI is pushing the half-century-old American energy grid to the breaking point.

Its a damned if you do, damned if you don't dilemma.

The U.S. needs the innovation and growth that AI brings, but it also can't afford to experience major power outages because of the technology's power-hog status.

Fortunately, an 81-year-old technology could be the answer, and it is now experiencing a huge renaissance.

Enter the Oppenheimer Project.

In the webinar accompanying Ian's report, it is revealed that Nuclear Energy is the solution to America, and the world’s growing need for energy.

The International Atomic Energy Agency admits that nuclear power can generate low-carbon energy 24 hours a day, 7 days a week. Plenty of others recognize this too, including tech overlords like Jeff Bezos, Mark Zuckerberg, and even investing GOAT, Warren Buffett.

Ian is also a big believer in nuclear power, saying that a group of little-known stocks “could give us the chance to earn 1,355%,” but the clean energy source still faces some major roadblocks.

The Pitch

A total of five stocks are teased, which are revealed across an equal number of special reports.

All we have to do is join Ian's Million Dollar Portfolio investment newsletter to get immediate access to these investments.

The cost is $997 for a one-year subscription, backed by a twelve-month money-back guarantee.

The Great Nuclear Bottleneck

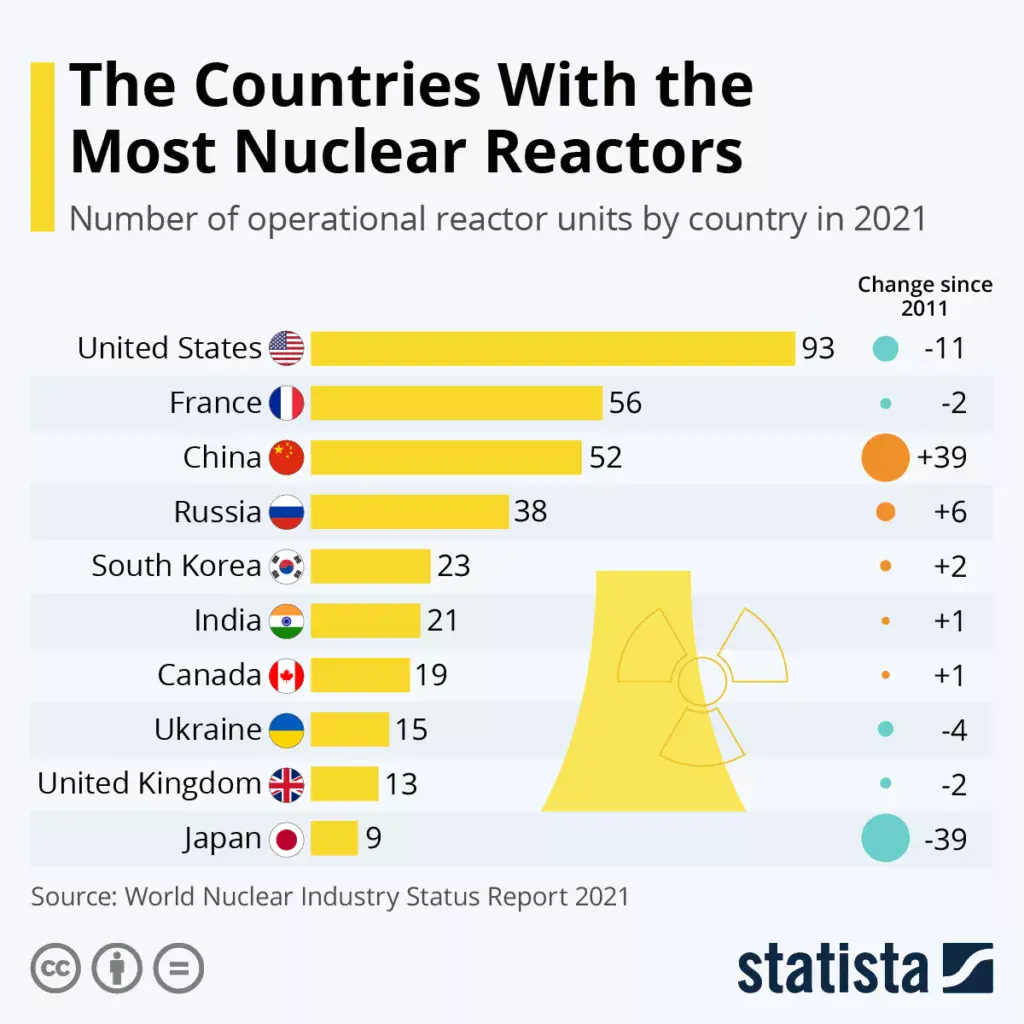

There are 93 operating nuclear power reactors in the United States, more than in any other country in the world.

That's the good news.

The bad news is that almost all of America's nuclear generating capacity comes from reactors built between 1967 and 1990. These are not enough to meet AI's insatiable energy needs.

At least 19 applications for 21 new reactors have been submitted to the Nuclear Regulatory Commission (NRC), but thus far, not a single one of these has received the green light.

Meanwhile, approximately 70 nuclear power reactors are currently under construction in 15 countries that are not the United States. Even worse, 31 of these are located in China, which has big AI dreams that I am sure they will turn into a non-Orwellian reality.

Trump is taking aim at this by declaring a national energy emergency in January, and more recently, ordering the nuclear regulatory agency to rule on all new license applications within 18 months.

This is a good start.

Another promising development is the emergence of small modular reactors (SMRs) that take less time to build and cost less than traditional plants. These come with their own potential safety risks, but that's another discussion.

Trump's EO also seeks to jumpstart uranium production and enrichment, which underpin nuclear power, and that is where Ian's “Oppenheimer” picks start.

Revealing Ian Wyatt's Oppenheimer AI Stock (and more)

Ian slyly keeps the clues to a minimum, but we still got something on most of his picks.

America's #1 Uranium Stock

- It just began production last August, and the U.S. government has agreed to a $30 million purchase.

- The company has reserves valued at over $22 billion.

This sounds like Uranium Energy Corp. (NYSE: UEC).

- Last August, UEC restarted operations at its Christensen Ranch uranium project in Wyoming.

- The miner formerly won a contract to supply 300,000 pounds of uranium concentrates to the Department of Energy's (DOE) Uranium Reserve program.

The New Energy IPO

- The founder of OpenAI (ChatGPT), Sam Altman, is personally invested in this next-generation energy startup to the tune of $300 million.

- It is a recent IPO.

An easy one here, it is Oklo Inc. (NYSE: OKLO).

- Oklo went public last May through a reverse merger transaction to much fanfare. Sam Altman is a major shareholder, with a stake of nearly 5%, and Oklo's former board chair.

The Next Generation Energy Monopoly

- The U.S. government has given one company a virtual monopoly with a $150 million contract.

Not very much to go on, but Centrus Energy Corp. (NYSE: LEU) could be the pick.

- Centrus received a $150 million DOE contract in late 2022 to produce high-assay low-enriched uranium (HALEU).

The First Oppenheimer Project

- This is the only company approved to build a next-generation Oppenheimer Project (Small Modular Reactor).

Again, not much to go on, but this has to be NuScale Power Corp. (NYSE: SMR), which is the only U.S. company with an approved nuclear reactor design.

The World’s Largest New Uranium Project

- One tiny Canadian stock has staked over 700,000 acres, right next door to the #1 mine in the world.

- They’re sitting on 250 million pounds of uranium worth over $20 billion

Dennison Mines Corp. (NYSE: DNN) appears to be the pick here.

- Dennison has interests in approximately 700,000 hectares in the resource-rich Athabasca Basin region of Canada, which has been dubbed the “Saudi Arabia of Uranium.” Some of this land is adjacent to Cameco Corp.'s Cigar Lake mine, which is considered the largest uranium mine in the world.

Turn $5K into $67,750?

Ian's thinking isn't wrong.

AI is going to need a lot more energy, America's grid is outdated, and nuclear power is one of the only viable solutions.

But are his picks the best way to play the nuclear energy renaissance?

There is a common thread among all of Ian's picks, besides the obvious.

Without exception, UEC, Oklo, Centrus, NuScale, and Dennison are all at the exploration or development stage.

That means little to no revenue, no profits, and definitely no dividends. Sad.

However, all are long-term bets on nuclear being one of the things that ultimately powers AI, which it will be, alongside fossil fuels.

The best performer of the bunch so far this year has been Oklo, up an impressive 142% on the back of Trump's EO streamlining nuclear regulatory approval.

But, if I had to pick just one stock to buy out of these, it would be Centrus Energy due to it holding one of only two Nuclear Regulatory Commission (NRC) licenses for low-enriched uranium (LEU) and the only license for HALEU enrichment.

This gives it a competitive advantage, as ultimately, no nuclear power can be generated without enriched uranium.

Quick Recap & Conclusion

- Stock market vet Ian Wyatt is betting that “Oppenheimer AI” will be the most profitable trade of the year.

- Artificial intelligence, crypto, and everyone's cell phone addiction are driving the demand for energy through the roof. Nuclear Energy is one solution, and Ian is all in on it.

- A total of five stocks are teased, which are revealed across an equal number of special reports. All we have to do is join Ian's Million Dollar Portfolio investment newsletter and pay $997 to get the names.

- The number of clues was limited, but we still managed to reveal most, if not all, of Ian's picks for free. They are: Uranium Energy Corp. (NYSE: UEC), Oklo Inc. (NYSE: OKLO), Centrus Energy Corp. (NYSE: LEU), NuScale Power Corp. (NYSE: SMR), and Dennison Mines Corp. (NYSE: DNN).

- My favorite pick here is is Centrus Energy due to the Nuclear Regulatory Commission (NRC) licenses it holds for uranium enrichment, a must-have for nuclear power. The stock is also up 55% year-to-date.

What is your favorite way to play the nuclear energy renaissance? Tell us in the comments.