Hugh Grossman has been profitably trading options for more than 13 years.

Now, the options savvant has developed a “Daily Payout Plan” using a single super-simple option that produces a 91% win-rate, and takes just 10 minutes every morning.

The Teaser

“A whole new approach to trading that I never thought possible.”

This is how the Daily Payout Plan is described.

However, before Hugh distills his secret sauce, he tells us what the Daily Payout Plan isn't…

It’s not complicated, spread options, naked puts, straddles, strangles, or iron condors. It’s simple call and put trading.

As per his X bio, Hugh is “a master pianist who happens to trade options.” Grossman founded the DayTradeSPY trading education service, which he sold to Eagle Financial Publications, but he remains the head trader.

Having previously looked at Jeff Clark's Gold Trading Strategy and Bryan Perry’s “Underground” Options, we're no strangers to such teasers.

This one starts with a similar, comforting claim: No matter the market conditions, the “plan” will deliver profits.

The Daily Payout Plan recommends trading simple “call” options when the market soars, and “put” options when it sinks.

It's how the strategy was able to bag wins across January and February 2023, while the market rallied over 6%, and began a six-week slide, respectively.

It was the same story in March.

The market stumbled:

But Hugh produced 21 winning trades:

Notching an unbelievable 118.4% return for the month.

How did this invention, which may equal the Great Pyramids of Giza, come to be?

High-Probability Trades

Until recently, Hugh has only shared the Daily Payout Plan with his family, friends, and a small circle of traders.

Now, he's ready to let us in and admit that his plan isn't all that different from what professional traders do daily – high-probability trades.

Their average gain per trade, including losses, is 3.9%. But they are consistent, and these small gains create significant returns when strung together.

This is the foundation of Hugh's options trading strategy: small, high-probability, consistent trades added together.

But what does a high probability trade consist of, how exactly do we execute the trades, and what ticker symbol are we trading?

The Pitch

We reveal everything below, but the only way to get daily trade alerts via email is by subscribing to the Pick of the Day trading advisory service.

A three-month trial costs $399 and includes a 30-day money-back guarantee, and a specific call or put option recommendation almost every trading day before 9:10 am EST

when the market opens.

The Glitch in the Market

A few years ago, Hugh detected a “glitch” in the way major exchanges perform.

It led to the development of the Daily Payout Plan because it enables high-probability trades.

The “big discovery” is that major market indexes, like the S&P 500, trend strongly first thing in the morning. They trend up or down just long enough to make a quick profit.

Hugh's proprietary system projects the likely direction of the market 30 minutes before the open, and an email is sent out to Pick of the Day members on which SPDR S&P 500 ETF Trust (NYSE: SPY) option trade to execute for the fastest returns, aiming for a profit of 6%.

Ordinarily, Hugh is in and out of the trade in under an hour, and he washes, rinses, and repeats the next day.

That’s all there is to it.

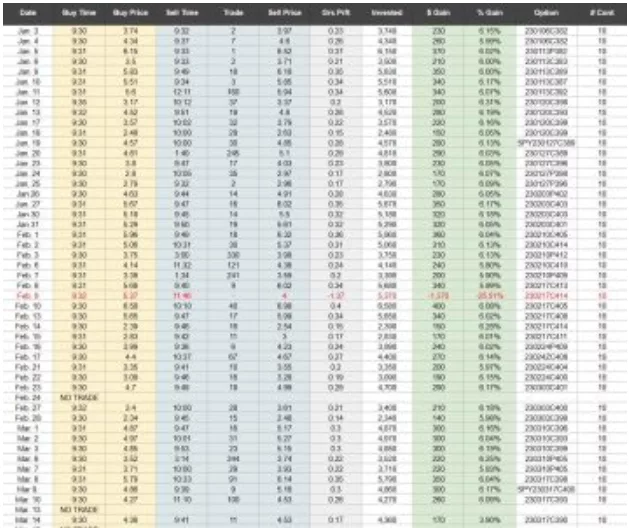

Since the strategy went live in January 2023 through December 2024, Hugh used it to make 430 total trades. He claims 395 of these were wins, and only thirty-five were losses, for a 91% win rate.

He even posts a long, fuzzy screenshot of his trades during this period. Here is a snippet:

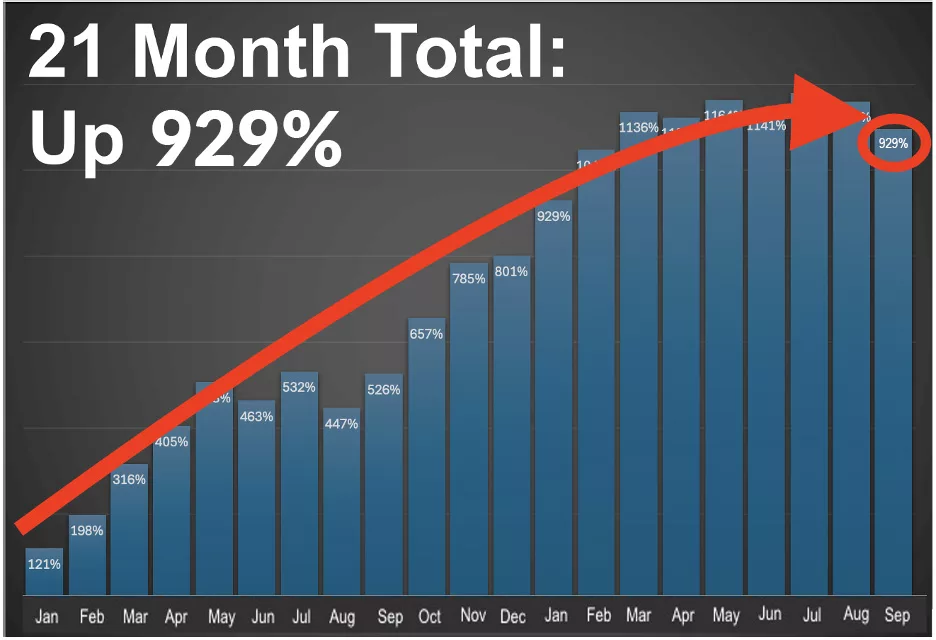

The total return, including losses, over these 21 months comes to an impressive 929%.

How replicable is this strategy? And what isn't Hugh telling us about the Daily Payout Plan?

Make 6% Per Day?

Statistically, 9 out of 10 options traders lose money.

This is only slightly better odds than buying a lottery ticket. What are the chances that we are the exception?

The imaginary magic eightball says…not good. For two reasons:

No Independent Reviews

One of the more interesting and perplexing things about the Daily Payout Plan is that I wasn't able to dig up a single review online from anyone who has used the service. Only paid advertorials like this one from websites made to look like legit newspaper sites.

I get that the strategy is relatively new, but DayTradeSpy has been around for 14 years now, and there is precious little info on it either, outside of its own content and guest posts.

It's a bit of a red flag, as anyone subscribed to the service and making anything close to 6% per day would be raving about it.

There is also another thing that makes me cast doubt on the applicability of Hugh's results…

High Accuracy, Big Losses?

Throughout the teaser, the 91% win rate of the Daily Payout Plan is mentioned no less than 19 times! Talk about driving the point home.

However, what is mentioned only sparingly is the median size of losses.

Using February 2023 as an example once again, the plan racked up 17 wins that month, with one 26% loss. Combined, all of these trades produced a total gain of 77%.

From this, we can deduce that the median gain across the 17 wins was 4.5%.

Another example is May 2023, which saw 21 more wins against only one loss. These 21 wins added up to a total gain of 103% (4.9% per trade). The one loss…27%.

This confirms my suspicions about high accuracy, with big losses.

Now, if you're a seasoned trader, this isn't that big of a deal, as you know how to choose strike prices and timeframes. If you aren't, options trading takes some getting used to, and one big loss could easily override all of your smaller gains.

I'm speaking from experience here, as long before I became a devout value guy, I tried my hand at equities trading in my early 20s, and blew up my modest account of several thousand dollars faster than fireworks on the fourth of July.

The main culprit: Not knowing how to cut my losses short and let my winners run, which is what I am seeing here.

Overall, the Daily Payout Plan is relatively easy to execute, but it isn't replicable without a subscription to the Pick of the Day, which projects the likely direction of the market 30 minutes before the open.

Hugh doesn't elaborate on what indicators are used to accomplish this; that's the “secret sauce.” But the extremely short-term nature of the trades, lack of third-party reviews, and the fact that losing trades typically have larger losses than wins, put me off.

Quick Recap & Conclusion

- Professional options trading savant Hugh Grossman has developed a “Daily Payout Plan” using a single super-simple option that produces a 91% win-rate, and takes just 10 minutes every morning.

- The Daily Payout Plan is a call and put options trading strategy that relies on a proprietary system to project the direction of the market before the opening bell and utilizes the heavily traded SPDR S&P 500 ETF Trust (NYSE: SPY) to maximize profits.

- The only way to know which SPY trades are being recommended every day is to subscribe to the Pick of the Day trading advisory service. A three-month trial costs $399, and it's the only way to get daily trade alerts before the market opens.

- Statistically speaking, 9 out of 10 individual options traders lose money. So the odds are against us from the jump. The lack of independent third-party reviews, a historical tendency for losses to be larger than wins, and the frequent nature of trades driving costs up, all make the Daily Payout Plan a daily chore.

Have you tried Hugh's Daily Payout Plan? Tell us about your experience in the comments.