One of the most explosive trends in the market is Bitcoin Treasury companies.

It’s already increased some stocks value by 34x and Nick Giambruno's Financial Underground has found the “#1 Bitcoin Treasury Stock” that could offer similar or even greater upside.

The Teaser

It's being called the most powerful arbitrage strategy in history.

Nick Giambruno is a speculator. He doesn't hide this fact, it's in the header image of this teaser and on his About page.

His bio also states that he looks for “investment opportunities in markets most investors ignore or misunderstand.” It may be the first accurate one we've read.

We have previously reviewed and revealed his #1 Gold Stock and Bitcoin Mining Stock.

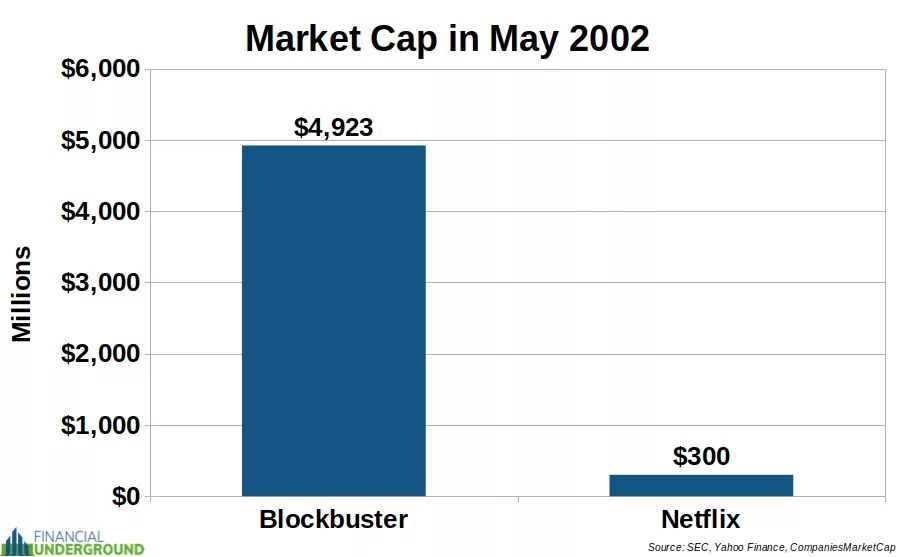

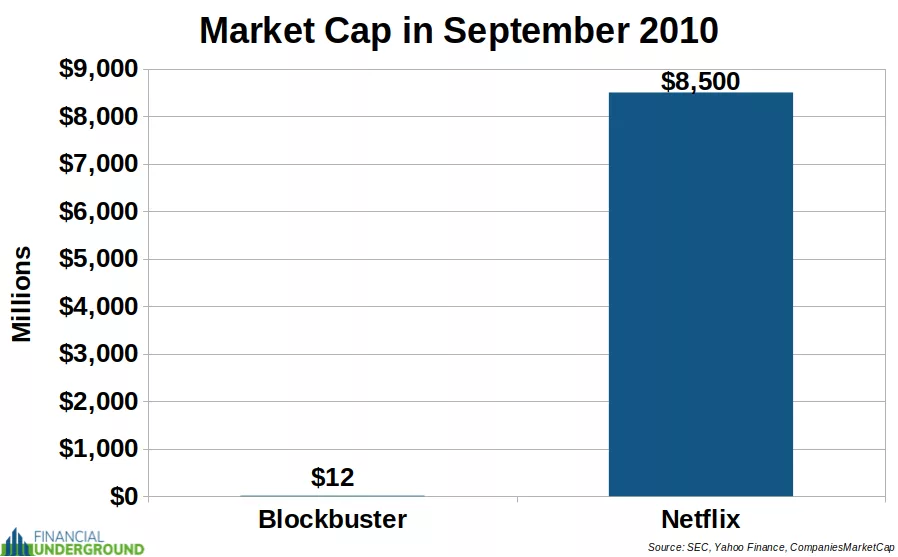

To properly grasp the scale of what’s unfolding, Nick cites one of the most famous business case studies.

Netflix and Blockbuster.

You have probably heard the story told by now, but this is what it looks like in two charts.

When Netflix went public in May 2002:

When Blockbuster filed for bankruptcy in 2010:

This is an outlier if there ever was one, but it does show what’s possible when a disruptive force transforms an industry or creates an entirely new one.

Nick believes the opportunity with Bitcoin Treasury Companies is orders of magnitude bigger.

Disrupting Money

Unlike a Netflix, Google, or Amazon, which redefined their respective industries.

Bitcoin has the potential to change money and transform the entire global financial system in the process.

This is because it's supply is limited, decentralized, and not controlled by any government.

Some, like Strategy (Nasdaq: MSTR) CEO Michael Saylor were early to recognize Bitcoin's potential as a neutral global reserve asset similar to gold.

Since pioneering the Bitcoin treasury strategy, it's stock has been one of the best performing of the past five years.

Others, such as MARA Holdings (Nasdaq: MARA) joined in later, but it's stock is also up 1,500% over the same time frame.

Even President Trump's Media and Technology Group (Nasdaq: DJT) has recently become a Bitcoin treasurer.

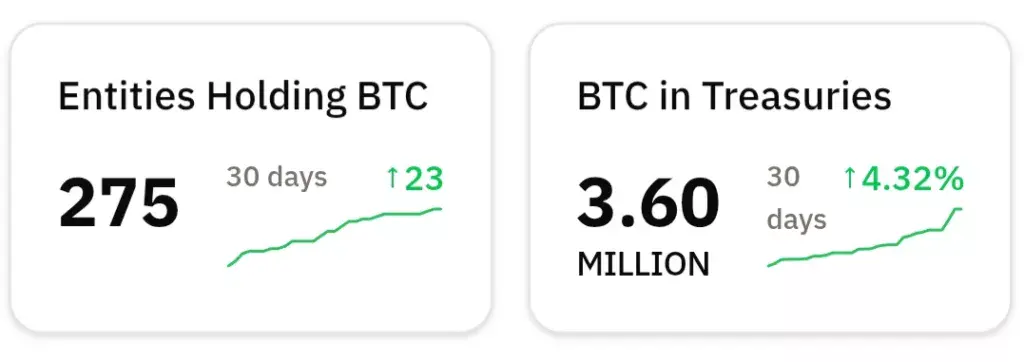

Clearly, adoption is accelerating:

However, it's still early, and the window of opportunity is wide open.

Nick believes the next wave of Bitcoin Treasury Companies will bring even bigger gains, and he's set his sights on one in particular.

The Pitch

It's name is only revealed in a report called The Next MSTR—Our #1 Bitcoin Treasury Stock Right Now.

The is free…to members of Nick's Financial Underground: SPECULATOR newsletter, which costs $1,799 to join for the first year (regularly $2,499).

The Core of the Arbitrage

Look at the corporate balance sheets of publicly traded companies and you will notice some similarities.

On the current assets side of the ledger, most will show some cash and maybe money market fund holdings.

However, more and more companies are realizing that holding depreciating dollars or the equivalent, isn't the most best use of their capital.

A small, but growing number, have discovered a way to turn depreciating fiat currencies into Bitcoin, at scale.

This is the core of the Bitcoin treasury strategy:

Raise capital by issuing low-interest debt or equity at a premium and converting that capital into a high-performing asset, like Bitcoin or another digital asset.

Taking low-yield fiat that is losing value and turning it into a hard, appreciating asset is a sound play.

Extrapolated out, the implications are massive.

An Emerging Megatrend

For example, the largest market in the world is the $100 trillion plus bond market.

Institutions, sovereign wealth funds, and even central banks have trillions invested in the bond market.

Yet 30-year U.S. Treasury yields are under 5%, making their real return negative.

If just 1% of these trillions in capital gets redirected into Bitcoin the inflows would be massive, and so would the returns to Bitcoin treasury companies and their shareholders.

Bitcoin adoption, especially at the institutional level, is in its infancy. We can still position ourselves to capture the bulk of the returns from institutions de-dollarizing.

Revealing Financial Underground's #1 Bitcoin Treasury Stock

The tiny stock Nick says is leading the charge on the next wave of Bitcoin treasuries is:

- A former small hotel chain in Asia.

- Adopted a Bitcoin treasury strategy just over a year ago.

- It's goal is to join the “1% Club” by acquiring 210,000 BTC or 1% of the entire Bitcoin supply.

Nick is talking about Metaplanet Inc. (OTC: MTPLF).

- Metaplanet is a Japanese hotelier turned Bitcoin Treasury company.

- It began implementing it's Bitcoin-first strategy in May of last year and it's CEO, Simon Gerovich, has gone on record saying the company's “strategic objective is to accumulate up to 210,000 BTC by the end of 2027.”

Turn $5,000 into over $430,000?

As a deep value guy, it seldom gets better than hearing about an asset play with upside potential, and a clear catalyst.

Metaplanet might have at least two of these qualities.

But first, some may be wondering, hey, why not just buy Bitcoin directly if you want to own it?

The answer is, the charters of some institutional fund prevent them from directly owning Bitcoin or any digital assets, so this is one way for them to in-directly do so.

For those who can buy it directly, like us individual investors, owning a solid business that is also asset-backed is better than owning one that isn't. Always remember the first rule – Safety of principal.

I recognize the leverage and liquidity risk for companies that turn into de-facto Bitcoin treasury funds only from a mile away. That is why I'm only interested in those with operational components, which also hold non-fiat denominated assets.

From this standpoint, Metaplanet does own a centrally-located hotel in downtown Tokyo, Japan and a dedicated Bitcoin magazine.

However, per Metaplanet's latest earnings presentation, 88% of profits now come from it's Bitcoin income generation strategy that consists of premiums from cash-secured puts on it's Bitcoin holdings.

As of the time we hit the publish button, the company trades at 17x it's net asset value (NAV) due to it's $4.2 billion debt load. A not so decent entry price for an asset play with marginal operations.

Unless the company plans to further diversify it's income streams beyond Bitcoin, which I have not heard, I would not be a buyer here, especially if you already have exposure to “digital gold.”

Over the short/mid-term, I see Metaplanet's share price continuing to outperform based on the Bitcoin treasury hype, but the real test to the strategy will be how such leveraged companies fare during a digital asset bear market. Time will tell.

Quick Recap & Conclusion

- Bitcoin treasury stocks are all the rage, with some increasing in value 34x, and Nick Giambruno's Financial Underground has found the “#1 Bitcoin Treasury Stock” that could offer similar or even greater upside.

- The core of the Bitcoin treasury strategy is companies raising capital by issuing low-interest debt or equity at a premium and converting that capital into a high-performing asset, like Bitcoin.

- Nick reveals a “next wave Bitcoin treasury stock” in a report called The Next MSTR—Our #1 Bitcoin Treasury Stock Right Now. We can get the report for free…if we join Nick's Financial Underground: SPECULATOR newsletter, which costs $1,799 for the first year.

- Greenbull readers can put the plastic back in their pockets, because we revealed Nick's pick for free, it's Metaplanet Inc. (OTC: MTPLF).

- Metaplanet is looking more like the Strategy (Nasdaq: MSTR) of Japan, a pure play Bitcoin treasurer, rather than a business which also happens to own Bitcoin.

Are you on or off the Bitcoin treasury company wave? Tell us in the comments.