Exponential technological progress is reshaping our world.

The change will come to the economy and then to the stock market, on one side will be failures on an unprecedented scale, on the other, wealth coming from some very surprising companies.

Eric Fry has a total of seven “sell this, buy that” recommendations that could double over the next 12-24 months.

The Teaser

There have always been “sacred cows” believed to be too big, too iconic, and too important to fail.

Eric Fry needs no introduction here at Greenbull, we have reviewed so many of his investment teasers, such as his AGI Stocks for 100x Gains and “America's Final Invention” Pitch, that he is a permanent fixture like furniture.

General Motors was one of these sacred cows.

At it's peak, it was the world's largest automaker. Producing more than 9 million vehicles worldwide in 1978, while employing over 620,000 workers.

Just one of its domestic assembly plants covered 40 football fields.

By 2007, that plant was shut and GM filed for Chapter 11 reorganization in 2009.

Around the same time, Eric recommended going long in a company called Metal Management, Sims Limited (OTC: SMSMY), today.

As one of the largest full-service metal recyclers in the country at a time when steel prices were soaring, it was a no-brainer.

This is what happened next:

Eric believes we’re about to see many more examples just like GM and Sims Limited, with pairs of stocks speeding in totally opposite directions.

The best part is, he's naming names and dropping the ticker symbols of 8 “sell this, buy that” recommendations in the presentation and we're going over each in depth.

Eric Fry's Buy This, Sell That Recommendations

Eric doesn't waste any time, he gets right into it.

Something that we are grateful for here at Greenbull after sitting through countless presentations that were longer than they needed to be.

1st Pair

Surprisingly, Eric's top sell call is Amazon (Nasdaq: AMZN).

He's bearish because 70% of what you see on Amazon comes from China and tariffs on those goods are obliterating Amazon's economies of scale competitive advantage.

He adds that Amazon's growth driver, it's cloud service division has missed analyst expectations for three straight quarters.

What does Eric recommended we buy instead?

The “Amazon of South Korea,” Coupang (NYSE: CPNG).

He argues it's like finding Amazon in 2005, but with a bigger competitive advantage and stronger momentum.

2nd Pair

Tesla (Nasdaq: TSLA) is getting crushed around the world by cheaper Chinese EV competitors like BYD, which is selling its vehicles for just over $10,000. One-third of what the lowest-priced Tesla costs.

As for the Optimus robot catalyst, there isn’t even a pre-order system for it like there was for Tesla’s initial car models. So a launch could be further away than anticipated.

Unlike their humanoid counterparts, Symbotic's (Nasdaq: SYM) logistical robots are installed like Lego blocks, and they are faster, and capable of carrying heavier loads.

3rd Pair

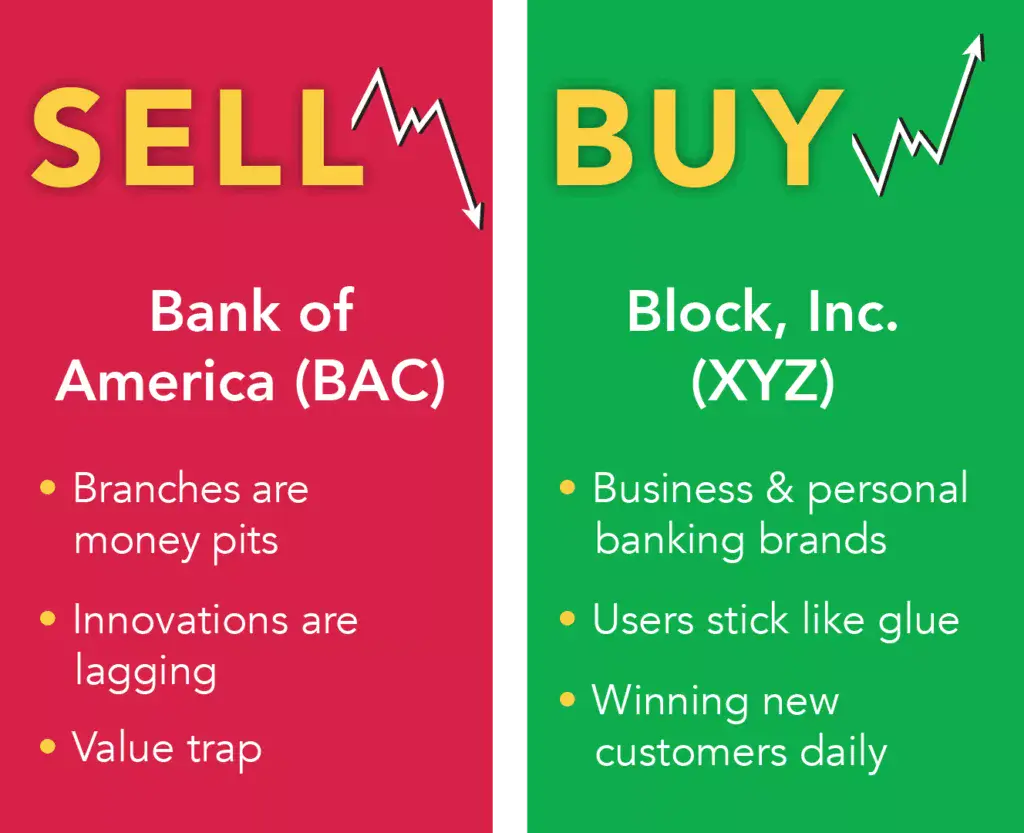

This financial sector pair is a play on the growing rift between traditional banking and financial technology (Fintech).

Simply put, Block's (NYSE: XYZ) Cash App is replacing the bank account and BAC can't offer anything fintech companies don't already do.

4th Pair

Eric's most controversial call yet.

Due to increased competition with everyone and their brother now starting to make computers chips, and just four companies making up 46% of Nvidia’s (Nasdaq: NVDA) entire business, the big money has already been made in the stock.

Meanwhile, Corning (NYSE: GLW) is the leading supplier of what every data center desperately needs – optical-fiber cables.

New AI data centers need 10 times more cables than regular data centers and as of Q1, Corning's production of AI fiber is tripling every month.

However, this is where the fun stops.

We do not get anymore names and tickers, instead, we get a plug for 11 more “Sell This, Buy That” recommendations.

The catch is, their names are scattered across three special reports:

- The $24 Trillion Rise of Robotics

- The Race to AGI

- Energy’s Swan Song

In order to access them, we need a subscription to Fry's Investment Report newsletter. This normally costs $499, but it's $99 for the first year, for a limited time.

Unfortunately, no clues are provided about any of these in Eric's presentation, but we have more than enough to analyze with his first 8 “Sell This, Buy That” recommendations.

Double Your Money over the Next 12 Months?

At the very least, no one will be able to look back at this and accuse Eric of simply following the consensus.

Issuing sell calls on Amazon, Tesla, and Nvidia at this stage is a bold move, especially since his buy calls don't look that much better.

For example, despite being a regional player with worse underlying economics, Coupang sells for an astonishing 188x forward earnings, compared to Amazon's 35x forward P/E.

Similarly, Symbotic, which made nearly $1.8 billion in fiscal year 2024 revenue while generating a net loss of $51 million, is currently valued at $31 billion.

Everything has to break right for it over the next few years just to live up to this lofty figure.

However, I do like Corning due to the optical-fiber angle at 26x forward earnings and Block provides the best value/growth combo out of all of Eric's buy recommendations, at 16x current earnings, with a steady 10-15% annual growth rate.

Could the market could get even more irrational and double any of these four names over the next year? Sure, but relying on greater fools to justify an investment is no better than betting on a blind man to win a darts competition.

Corning and Block's value is obvious regardless of what the market does, and sooner or later, it will be realized.

Remember, over the short-term, the market is a voting machine, where popularity rules the day. But over the long-term, it's a weighing machine, with valuation, economics, and growth weighing heaviest.

Quick Recap & Conclusion

- Exponential progress is reshaping the world as we know it, and Eric Fry has several “sell this, buy that” recommendations that could double over the next 12-24 months.

- This massive change is coming to the economy first and then to the stock market, where on one side there will be failures on an unprecedented scale, and on the other, wealth coming from some very surprising companies.

- Eric provides 8 “sell this, buy that” recommendations in total, while putting 11 more in three reports, which require a subscription to his Fry's Investment Report newsletter to access. The cost to sign up is $99 upfront for the first year.

- The four sell recommendations are Amazon (Nasdaq: AMZN), Tesla Inc. (Nasdaq: TSLA), Nvidia Corp. (Nasdaq: NVDA), and Bank of America (NYSE: BAC), with the four buy recommendations being Coupang Inc. (NYSE: CPNG), Symbotic Inc. (Nasdaq: SYM), Corning Inc. (Nasdaq: GLW), and Block Inc. (NYSE: XYZ).

- Corning and Block are the best value/growth calls on the buy-side, with a real shot at doubling over the short-term given their undervaluations, while BAC may indeed be a value trap, and a good name to sell, if you own it.

Are we in a bubble or does AI innovation warrant the high multiples? Tell us what you think in the comments.