Eric Fry brands himself as the country's Top Trader and he's teasing the imminent launch of something called “America’s Final Invention.”

This invention goes far beyond even artificial intelligence and some stocks will skyrocket because of it.

The Teaser

If Eric's analysis is on the money, we could soon have a new class of high-flying stocks.

Eric Fry's “America’s Top Trader” moniker comes from winning the charitable Portfolios with Purpose competition…in 2016.

As a former portfolio manager, his real life calls include shorting tech stocks in 2000 and we've revealed several of his more recent picks, including his AGI and Next-Gen Stocks.

So what is this ultra disruptive final invention?

Eric says it's Artificial General Intelligence (AGI) or the moment Artificial Intelligence achieves human-like intelligence.

It's being called the final invention because AGI is capable of learning on its own and finding solutions to tasks its unfamiliar with. But this is just the start.

AGI's ability to self-learn and iterate will soon exceed not only the human brain, but the fastest computer systems in the world.

At that point, AGI will make ground-breaking discoveries and inventions all on it's own.

Not too long ago, this was the stuff of Doc Brown in Back to the Future. Now, it's just a matter of when, not if it will happen.

Toddlers And PhD's

Eric has planted a stake in the ground at 1,000 days until we reach AGI.

However, this may be the the far end of when we’ll achieve AGI, as there are indicators that it could happen much sooner.

A paper was published in 2023 claiming that ChatGPT's ChatGPT-4 already had “Sparks of Artificial General Intelligence.”

But the clearest sign of all, may be OpenAI o1, which was quietly released last September 12th.

The o1 model has exhibited PhD-level intelligence.

By comparison, GPT-3 had the intelligence of a toddler, and it was only released at the end of 2022.

We're barreling toward AGI at a blistering pace and now is the time to get in on what could be “America's Final Invention.”

The Pitch

Eric has put together a report called My 3 Top AGI Stocks for 1,000% Gains.

It outlines the best way to play the AGI market and comes included in a subscription to Eric's monthly investment newsletter, Fry's Investment Report.

Access typically costs $499 per year, but new subscribers can claim a trial offer for $99.

Exponential Growth Not Priced In

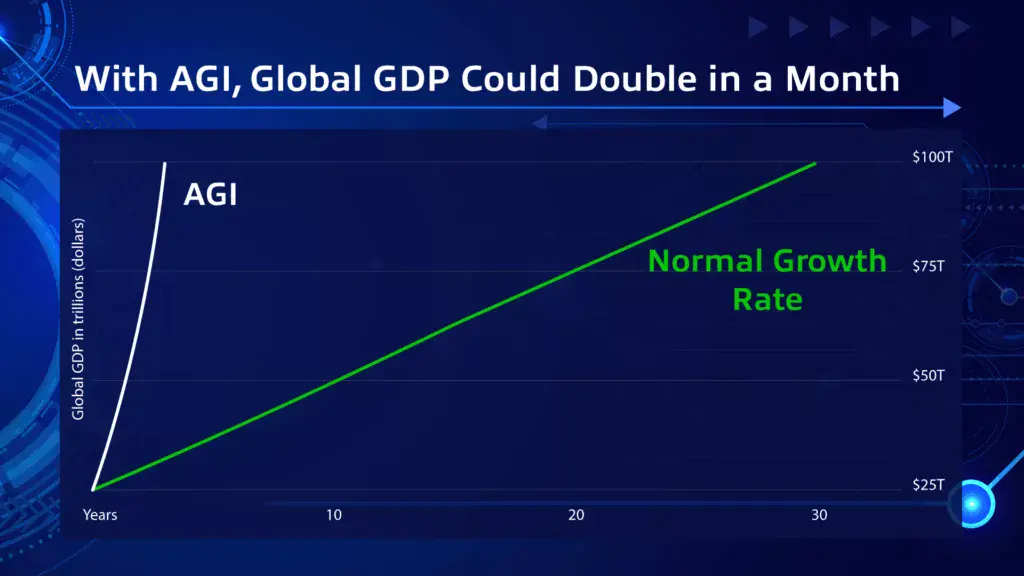

Right now the world economy doubles every 15 years or so.

It is also a well-established expectation that AI will add $15.7 trillion to the global economy by 2030.

Much of this is already baked into stock prices today. It's a big reason why the total market cap is more than 200% of GDP.

By all recent standards, it would appear that the market is overvalued.

However, one thing has yet to be priced into the stock market – the magnitude of AGI’s impact.

Some who have worked on AGI firsthand are so awestruck by it, they reason that if it were priced in, the market would 100x!

This is because “post-AGI” the world economy could speed up by as much as 250 times its normal rate. In other words, it could double every month.

Such growth would be unprecedented.

If just a small fraction of such projections come to fruition, and the economy begins doubling every 8 years, instead of 15, we're still in for some wildly good times.

The Singularity

Up until now, AI has doubled its intelligence roughly every six months.

But once self-learning computers start writing their own code, we could sew this shrink to mere months, weeks, or even days.

This is the singularity, the long-held holy grail of machine learning.

It could come before the end of the decade and certain stocks are primed to take off in this “pre-AGI” market.

Revealing Eric Fry's Final Invention Stocks

Instead of investing directly in AGI technology by buying semiconductor and software stocks, Eric is focusing on which stocks will indirectly benefit the most from AGI.

The Energy Infrastructure Play

- This is a little-known company that already operates in what could soon become the next “data center alley.”

- It provides essential infrastructure solutions to some of the biggest energy companies in the world.

- It's a small-cap stock trading for less than $30 a share.

This sounds like Solaris Energy Infrastructure Inc. (NYSE: SEI).

- Solaris provides infrastructure solutions like power and logistics to major energy companies.

- The company is headquartered in Houston, which is becoming a major data center hub.

- It is a small cap, with a $2 billion market cap and a share price that just hit $30.

The Fiber Optics Play

- It provides cutting-edge fiber optic cabling for most new data centers.

- The company recently pivoted to AI-focused solutions.

- It is projected to add more than $3 billion in annual sales over the next couple of years.

Eric is likely describing Corning Inc. (NYSE: GLW) here.

- Corning's franchise is fiberglass, but it now provides a one-stop shop for AI data center infrastructure needs.

- The specialty glass and optical product maker lifted it's projected revenue in Q2 2024, saying it now expects sales to grow by more than $3 billion over the next three years due to demand from data centers.

The Nuclear Energy Play

- This final pick is not only a direct play on every nuclear power plant in existence today, but also on all the brand new reactors being built around the world.

Based on the description, this has to be a uranium miner, as uranium is the one critical element that all nuclear reactors worldwide require.

This is a guess, but Cameco Corporation (NYSE: CCJ) is North America's largest uranium producer and one of the largest in the world.

1,000 Returns?

Eric says…

If the internet was as disruptive as a bull in a china shop, then AGI will be like the bull combined with a 300 MPH tornado.

If AGI turns out to be even a fraction of what is described here, the market will have it's biggest bull run ever.

The question is, do any of Eric's picks have a snowball's chance at being among the biggest winners?

Solaris Energy: As a deep value guy, a P/E ratio of 50 frightens me like a small child who is served broccoli for dinner.

However, Solaris is small enough and positioned in such a way that it should generate above-average returns, even from this price level.

Corning: It's even more expensive than Solaris, with a current P/E of 67. But it's forward P/E is only 25, thanks to the expected revenue and earnings growth.

It may beat the market, but Corning won't produce the kind of gain teased in Eric's presentation.

Cameco: I'm not positive this is one of Eric's picks, although Cameco is a solid AI and AGI infrastructure play, with a MOAT around it.

A $100 billion market cap could be in it's future, given that power consumption is expected to triple from now to 2030.

There's no immediate 1,000% return candidates in sight, but a multi-bagger and some market-beating returns are a good probability.

Quick Recap & Conclusion

- Eric Fry is teasing the imminent launch of something called “America’s Final Invention,” which goes beyond artificial intelligence, and some stocks could skyrocket because of it.

- The invention is Artificial General Intelligence (AGI) or the moment Artificial Intelligence achieves human-like intelligence, and we could be less than 1,000 days away from it.

- Eric has put together a report called My 3 Top AGI Stocks for 1,000% Gains, which outlines the best way to play the AGI market. A subscription to Eric's monthly investment newsletter, Fry's Investment Report is required to access it, which costs $99.

- We were able to reveal at least two of Eric's three “America's Final Invention” picks for free. They are Solaris Energy Infrastructure Inc. (NYSE: SEI), Corning Inc. (NYSE: GLW), and we also included an educated guess about the third.

- Neither of these picks are moonshots, but they are solid businesses, albeit slightly overpriced, that could turn out to be multibaggers over the next few years.

What is your best guess for when AGI will arrive? Drop it in the comments.