Artificial intelligence may be the most powerful and disruptive economic force since the birth of electricity.

However, investing veteran Eric Fry says it is now solidly in bubble territory and he's found six “AI Survivor” Stocks that will likely create more wealth for shareholders than the Magnificent 7 tech stocks in 2026.

The Teaser

According to Eric, protecting ourselves from the collapse of the AI Bubble is something we must take action on immediately.

Four decades of experience as a hedge fund manager, institutional analyst, and financial newsletter editor have given Eric some context and perspective.

It's what has informed previous calls like his AGI Stocks and “Sell This, Buy That” Recommendations, which we have reviewed here.

In this one, Eric is fully aboard the AI bubble bandwagon and his magic dollar store eightball tells him that the future is highly uncertain.

It’s December 2026.

Nvidia stock is down 70% from its highs. Meta is down 60%. And Amazon is down more than 50%.

It’s a bloodbath for the “Magnificent 7” stocks, the supposed leaders of the AI Age.

The average loss for all Nasdaq stocks is 59%.

Nearly $25 trillion in wealth has been wiped out in less than 12 months.

As soon as January, there will be millions of investors wondering where they should have moved their money before the AI Bubble popped

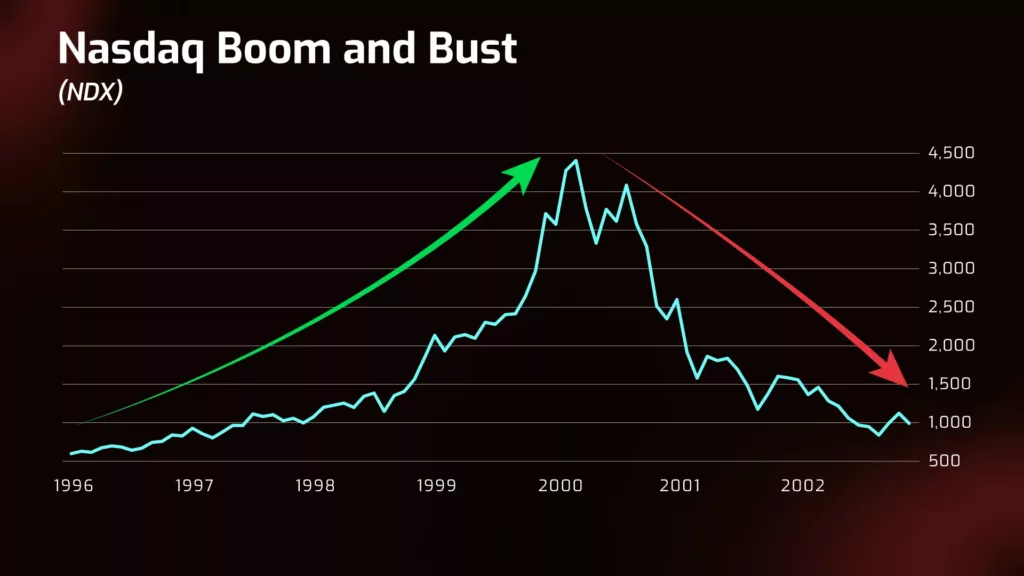

This dark prognosis is based on a very similar scenario that has already happened in our lifetime.

Eric, is of course, talking about the dot-com boom and subsequent bust of the early 2000s.

Back in those heady times the Nasdaq nosedived 77% from March 2000 to October 2022 and the “four horsemen of the internet” (Intel, Cisco Systems, Qualcomm, and Microsoft) lost nearly 80% of their value.

Some of these were still trading below their level of 25 years ago until only recently.

If an AI downturn plays out in similar fashion, it could take stocks 15 or even 20 years to return to their former highs, so for the sake of our portfolios, we can't afford to be complacent.

However, if and when the AI Bubble pops, trillions of dollars won’t just disappear. History shows investment dollars rotate.

In 2000, money that fled tech stocks didn’t all go to cash. It went into sectors such as healthcare, energy, and consumer staples, which ended up outperforming.

Eric doesn't necessarily believe that history will repeat itself this time around, but it will rhyme, and many “AI Survivor” stocks will outperform over the next few years.

The Pitch

All of Eric's stock picks and more are revealed in a new report called the AI Collapse Survival Guide.

There's only one way to get it and that's with a subscription to the Fry’s Investment Report financial research service.

One year's worth of access normally costs $499, but for a limited time, we can get in for a discounted $79, with a 90-day money-back guarantee.

5 Signs the AI Bubble is about to Pop

According to Eric, today’s AI boom is checking nearly every one of the boxes that indicated a bubble back in 1999.

Lofty Market Valuation

Driven by AI stocks, the cyclically adjusted price-to-earnings ratio, or CAPE ratio, stands at 39.65 for the S&P 500.

The last and only time it ranged that high was before the peak of the dot-com bubble in 1999. Welp.

Too much money into too few stocks

Today, the 10 largest stocks account for nearly 40% of the overall U.S. market.

This is Japan in the 1980s territory, when a handful of Japanese equities grew so large that they made up 42% of the entire world stock market value by 1989!

We're not quite there, as U.S. stocks currently make up ‘only' 16% of the value of all the stocks in the entire world, but it's not heading in the right direction.

The rise of risky IPOs

Remember Webvan? Pets.com? Or TheGlobe.com?

Meet Fermi Inc. (Nasdaq: FRMI).

A pre-revenue, pre-profit, no asset startup aiming to build the world’s largest private energy grid to power AI companies.

Despite it's only assets being a lease for a large patch of land near Texas Tech University and an unfilled order for nine gas turbines, it's currently valued at over $5 billion.

Circular financial deals

I'm sure most readers have already seen this graphic:

Well, the same phenomenon occured during the dot-com bubble, when telecom equipment providers started lending money to each other and to their biggest customers.

It turned out that recycling capital isn't as sustainable as paper cups.

More money invested in stocks than ever before.

Stock holdings, including mutual funds and retirement plans, are at an all-time high, making up 45% of household financial assets.

A figure that is higher than the dot-com bubble days.

All of this begs the question, what “ordinary” stocks should we be buying and owning?

Revealing Eric Fry's AI Survivor Stocks

All of Eric's picks have three things in common:

- High human interaction that can't be automated

- Physical goods or experiences that can't be enjoyed in a virtual world

- Proven business models with real revenue and profits

The Retail Superstar

The first company is revealed as a drive-through beverage chain that you might not have heard of unless you live in the Pacific Northwest.

It's Dutch Bros Inc. (NYSE: BROS).

People will still want coffee no matter what happens with AI, so it checks out.

Second AI Survivor

- This company is a pioneer in providing high-quality goods to the outdoors enthusiast.

- You’ll see its products on almost any fishing trip, beach trip, campout, or tailgate party you go to.

- As a sign of its confidence, the company recently authorized a major stock buyback program.

This sounds like American Outdoor Brands Inc. (Nasdaq: AOUT).

- AOUT owns well-known brands such as BOG, BUBBA, Caldwell, and Crimson Trace that will be recognizable to most fishing, camping, and outdoor enthusiasts.

- It announced a new stock buyback program for the repurchase of up to $10 million of its outstanding common stock that runs through September 2026.

Third AI Survivor Stock

- This company outsources most of the risks of drug development and simply takes a cut of the sales of drugs being developed by others like Biogen, Gilead, and AbbVie.

- In exchange for funding late-stage clinical trials, it locks in a perpetual royalty if the drug gets approved by the FDA.

- Jim Cramer has called it “the perfect way to play biotech.”

The “AI Survivor” is Royalty Pharma Plc (Nasdaq: RPRX).

- Royalty Pharma is the largest biopharma financier, with a portfolio of more than 35 commercial drugs. This includes a recent deal with Biogen, Abbvie's Imbruvica and Gilead’s Trodelvy, among others.

- The notorious Jim Cramer did indeed call it “the best way to play biotech.”

As for the remaining three AI Survivor Stocks, all we know is that they are in fertilizers, natural gas, and metals “that we need for everything from cars and planes to electrical plants and power lines.” No additional clues were forthcoming.

The Biggest Non-AI Winners?

Among all of the AI, quantum computing, and infrastructure teasers we regularly review, Eric's non-AI teaser is welcome and needed.

I share Eric's sentiment insofar as AI will live up to the hype over the long-term if some fundamental issues like energy capacity are resolved, but valuations have gotten a tad ahead of themselves.

A non-traditional balanced portfolio of growth and value plays are the answer, but do Eric's “AI Survivor” Stocks fit the bill?

Dutch Bros: I like the growth story, but at a forward P/E above 70, with a profit margin of 4%, the price is too bitter for me.

American Outdoor Brands: At a price below book value, with almost no debt, and a share buyback under way, there is value here, but growth is limited.

Royalty Pharma: The best pick of the three. A lean business model, regular dividends, and a current earnings multiple of only 22x.

Quick Recap & Conclusion

- The AI growth story is showing cracks and investing veteran Eric Fry has found a few “AI Survivor” Stocks that could create more wealth for shareholders than the Magnificent 7 tech stocks in 2026.

- Lofty market valuations, too much money in too few stocks, risky IPOs, circular financial deals, high exposure to the same stocks, Eric makes a strong case for an overheated market, and he has an anecdote.

- Eric has six “AI Survivor” Stocks and they are all revealed in a new report called the AI Collapse Survival Guide. It can be ours with a subscription to the Fry’s Investment Report financial research service, which costs a discounted $79 for the first year (normally $499).

- We were able to reveal the first three “AI Survivor” Stocks for free as Dutch Bros Inc. (NYSE: BROS), American Outdoor Brands Inc. (Nasdaq: AOUT), and Royalty Pharma Plc (Nasdaq: RPRX). All we know about the remaining three is that they are a fertilizer, natural gas, and metals play, respectively.

- Unsurprisingly, a royalty stock (Royalty Pharma), provides the best value for the price asked.

Is AI a bubble? Tell us why or why not in the comments.

Just FYI, I found from another source the stocks revealed other than BROS, YETI, RPRX include MOS and ELE. Thanks for ALL for your service.

Thank you for the heads up on this!

I like Eric Fry too; after Greenbull he’s my favorite newsletter – grateful that you cover him.

You’re right that he loves Dutch Bros and Royalty Pharma but his outdoor pick might be YETI, he’s been bullish on them for a couple of months.

Within the past few months he’s also done writeups for Devon Energy, and either silver or platinum ETFs. Not sure about fertilizer but I know Michael Burrie is pounding the table for Mosaic.

Thanks for your great work!

I haven’t commented in awhile, but I want you to know I appreciate what you do Anders.

Thank you Todd. We’re all thankful for our faithful followers too! Have a great New Year.

Hello, I am a fan of your articles giving free stock info.

Ordinary retired low income people like me who used to work many years and have not saved as we have kids to support just appreciate you. we cannot be big time investors and pay for info. I buy 1-2 stocks pre IPO less than $50. Big companies dont bother about us. they dont realize it

We need it most, we had worked & paid taxes for decades. Anyway Merry christmas and all the best for you. Grateful always.

We really appreciate this Maria. Merry Christmas and happy New Year to you!