50-year Wall Street veteran, Marc Chaikin, is concerned.

Artificial intelligence (AI) may be the hottest investment trend since the dot-com boom, but the biggest gains are shifting from well-known names to some “Hidden AI Stocks” that are flying under the radar.

The Teaser

There always has been, and always will be, some “next big thing” that makes early investors a fortune and costs them one too.

In 2023, Marc Chaikin issued a free recommendation of his favorite under-the-radar AI stock and that stock went on to notch a 100% gain.

We reviewed this pick and also previously looked at the Power Gauge Report promoted in this presentation.

Marc is hoping to duplicate the feat of his former #1 AI pick with today's teaser.

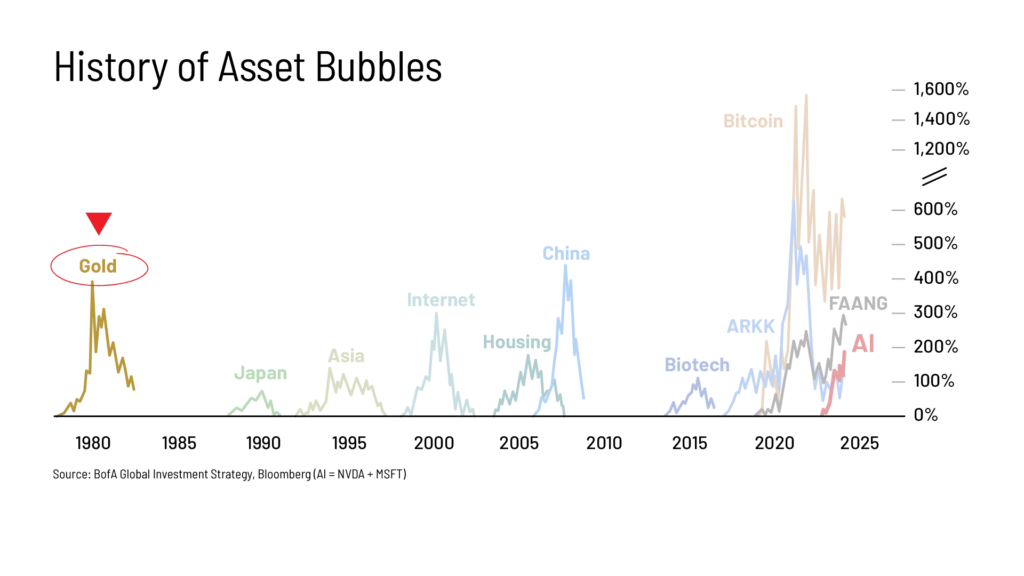

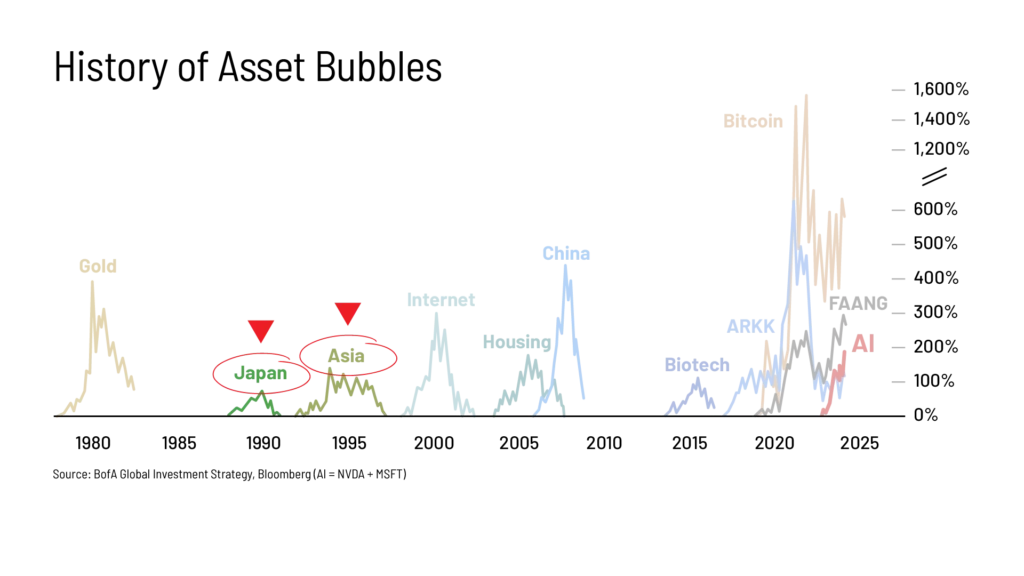

It starts with host Molly Hendrickson introducing Marc and him giving us a brief history lesson in market manias.

Tulips

Gold

Even Japanese and Asian stocks are mentioned.

The point is that investors who are unfashionably late to the party always end up getting hurt.

Such age-old mistakes are what Marc is here to save us from with AI stocks.

The Magnificent Seven, comprised of Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta, and Tesla were responsible for more than half of all the AI bull market gains in 2023 and 2024.

However, a shift is currently underway.

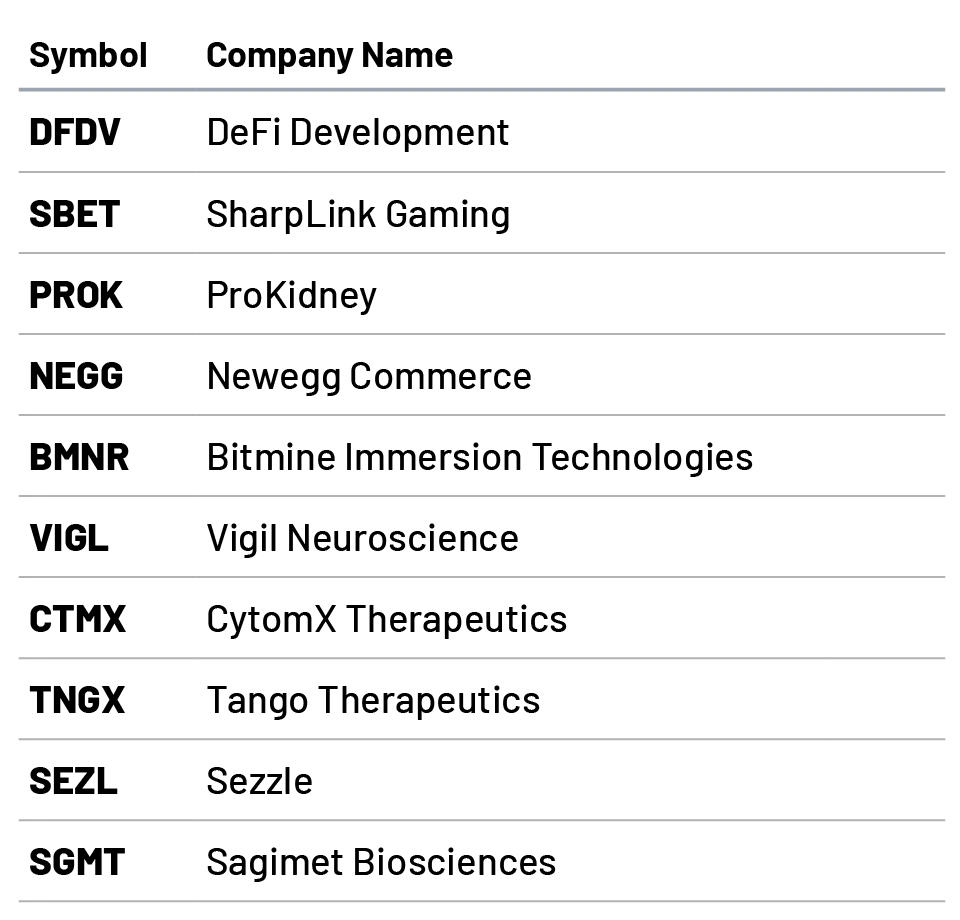

As an example, these ten stocks represent the biggest winners following the tariff induced sell-off in April:

A far cry from the Magnificent Seven, but they all have one thing in common.

They all leverage AI in some form.

If we zoom out and look at the top 50 best-performing stocks since the 2025 bottom, we'll see that over half have adopted AI into their respective businesses.

These smaller, lesser-known stocks that are now leveraging the latest AI technology are what Marc calls “hidden AI stocks” and they are where the extraordinary moneymaking opportunities lay today.

The Pitch

Marc has compiled the names, tickers, and his personal buying instructions on his “hidden AI stocks” into a special report called Chaikin's AI Power Picks.

All we need to get our hands on it is a membership to his flagship research service, Power Gauge Report.

Normally, access to Power Gauge Report would cost us $499 per year. But for a limited time, we can get it for $149, with a 30-day money-back guarantee.

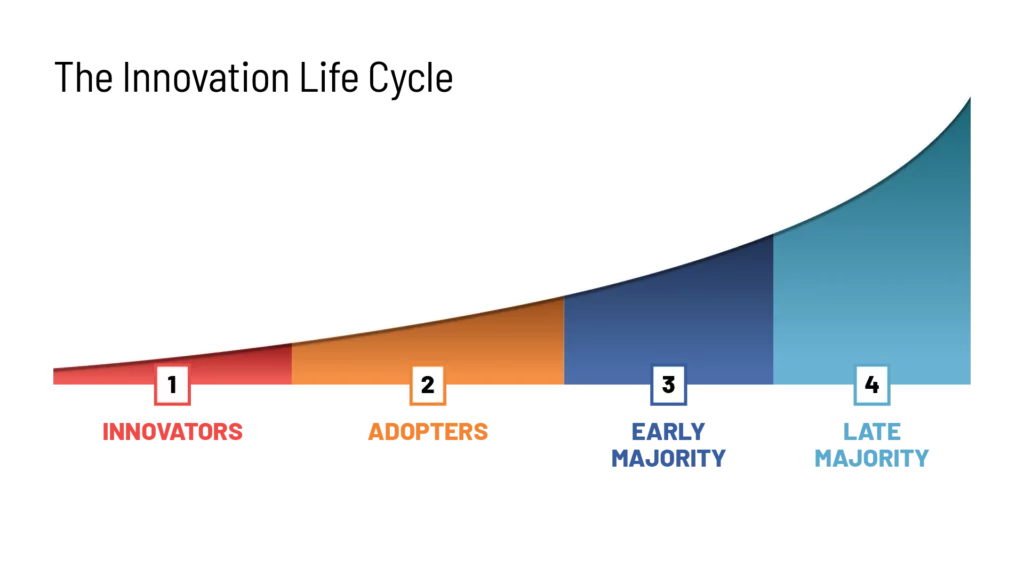

The Innovation Life Cycle

The thing behind this shift predates AI entirely. It's happened in every major innovation throughout modern history.

Midway through the presentation, Marc shows us a roadmap of how disruptive technologies go from initial idea to widespread adoption.

Every truly disruptive technology has gone through this cycle.

A small number of companies lead the initial charge, dominating all the early gains and then, as the innovation spreads, so do the gains.

During the dot-com boom, this was the “power five,” made up of IBM, Cisco, Intel, Microsoft, and Oracle. Before Adobe, Amazon, eBay, and others took over as innovation spread.

When it comes to AI, Marc believes we’re at the pivotal tipping point between innovation and early adoption.

If he's right, it means we are going away from the innovators, the companies that made AI possible. To the adopters, the companies now implementing existing AI technology for their own gain.

I don't disagree with this assessment.

If you step outside and talk to the average person, artificial intelligence is still as foreign a concept as eating monkey stew, like a foreign indigenous tribe.

We are squarely towards the end of the first stage or early in the second stage of the innovation life cycle.

From this standpoint, it makes sense that “hidden AI stocks” would be hiding in plain sight from everyone except early adopters and the most astute market observers, like those reading this Greenbull review.

However, half of all S&P 500 components are mentioning AI in their earnings calls, so how do we know which to ignore and which to take seriously?

It pays to be discerning and Marc says he's separated the contenders from the pretenders.

Marc Chaikin's Hidden AI Stocks

Marc's recommendations all have bullish ratings in his Power Gauge System and he says they could soar higher, and faster than anything else in the market over the months to come.

The first hidden AI stock is given to us and its Uber Technologies Inc. (NYSE: UBER).

Marc feels good about the company's expansion into driverless cars and trucks, and “ability to use AI to optimize profits and customer satisfaction.”

In the same breath, we are also given a no.1 AI stock to avoid – C3.AI (NYSE: AI).

No legit reason is given, apart from the stock's recent drop and that Marc doesn't want anybody bottom fishing in it because of the “AI” ticker symbol.

As for the four other hidden AI stocks, absolutely, positively no info is provided. We were shut out like a bad football team in the first week of the season.

However, this won't stop us from speculating on some possibilities, based on Marc's own admission that he's looking for overlaps or crossovers between today's dominant tech trends like blockchain, robotics, quantum computing, and AI.

One example is Serve Robotics (Nasdaq: SERV).

Not only does it lean on AI for decision-making for it's autonomous delivery bots, but SERV also has a partnership in place with Marc's first pick, Uber Eats, for a 2,000-unit deployment.

Rigetti Computing Inc. (Nasdaq: RGTI) is another example.

It's an AI/Quantum hybrid offering hardware, software, and cloud services for the next generation of applications.

There are others out there, but you get the idea. Question is, are they our best chance at multiple multibaggers?

Best Chance to Double or Triple our Money?

In the details and disclosures section (D&D), Marc's team states something obvious, yet profound:

The best thing an investment research product can bring you is a good idea that’s right for the market conditions and offers an overwhelming potential for success versus a moderate level of risk.

That said, the average 3-year gain in Power Gauge Report has been 11.1%.

I'll go out on a limb and say that the top pick in this teaser (Uber), will best this.

Looking at the company's financials and growth prospects, it's potential outweighs the moderate level of risk.

Debt could be lower, but at a debt/equity of 52%, its under control.

Return on equity is great, sitting above 60%, operating margins are improving, and cash flow is positive.

Autonomous vehicles will improve all of these key metrics and these are already being trialed in the US, and in international markets.

The stock is already up 50% so far this year, but at a current P/E under 20, the entry point is still good for a future double or better.

Quick Recap & Conclusion

- 50-year Wall Street veteran, Marc Chaikin is sensing a shift in the market and the biggest gains going forward won't be in well-known, mainstream names, but in some “Hidden AI Stocks.”

- This is due to The Innovation Life Cycle, which sees a small number of companies lead the initial charge, dominate all the early gains and then, as the innovation spreads, so do the gains.

- The cycle is now repeating with AI and Marc has compiled the names and tickers of his “hidden AI stocks” into a special report called Chaikin's AI Power Picks. It is ours with a subscription to the Power Gauge Report, which costs $149 for the first year.

- Despite the big talk, only a single “hidden AI stock,” which isn't so hidden or entirely AI, is shared. It's Uber Technologies Inc. (NYSE: UBER).

- After looking under the hood at Uber's financials and growth prospects, the pick is surprisingly good. Decent underlying economics, which will improve with the transition to autonomous vehicles, and a current P/E under 20 make it a solid candidate for a double or more.

What stage of the AI lifecycle do you think we are in? Let us know in the comments.