Professional trader Bryan Bottarelli is teasing a secret “Jolts Loophole.”

Its a trading strategy that gives us a chance to collect as much as 383% overnight whenever major reports like economic data on jobs, inflation, and GDP growth are released.

But is the risk/reward worth it?

The Teaser

One undeniable fact is at the heart of this strategy – when the government releases economic news, the market reacts.

Bryan Bottarelli calls himself a born trader.

He's been trading ever since arbitraging Star Wars figures as a kid and selling them for 50 times their value. Now, he's grown into a “play tactician” using his experience trading stock options on the Chicago Board Options Exchange (CBOE) floor to spot chart formations and deliver timely recommendations.

We have previously reviewed Bryan's “Dark Ticker” Trades and revealed if his Monument Traders Alliance are expert speculators or amateurs.

“An inflation report comes out and boom the markets shoot up.

A weak jobs report is released and instantly the sell-off begins.

Most people understand this, but don’t know how to play it.”

Now, for the first time ever, Bryan has a “brand-new investment and brand-new strategy” that will show us how.

Job Openings and Labor Turnover Survey

This is what the “JOLTS Loophole” is named after, as all we have to do is place a trade the day before a major JOLTS report comes out.

Here is an example…

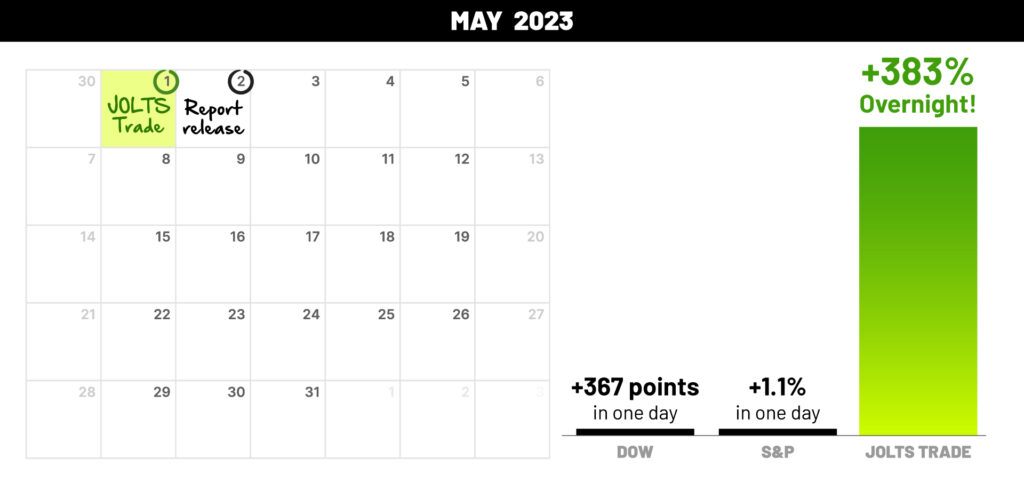

On May 2nd, 2023, the government released the jobs report, showing a weakening jobs market.

The only thing everyone was sure of, was that the market would have a big move, one way or another. In this case, the Dow moved 367 points in one day, while the S&P, surprisingly, went up 1.1%.

A JOLTS trade was placed on the eve of the jobs report and was up as much as 383% overnight!

The best part is, that it doesn't matter if the market moves up or down, the JOLTS Loophole works in either direction.

So, what is the trade, and outside of this one example, is the overall strategy any good?

The Pitch

Bryan's precise methodology is only broken down in a report called “The JOLTS Loophole: The Secret of HUGE Overnight Profits from Government Reports.”

Besides being among the first to discover this strategy for yourself, Bryan also includes an “Overnight Profit 2024 Calendar: The Government Reports That Could Be Your Chance for Overnight Profits” a “Pro Traders Options Guide” and an entire app with trade recommendations and instant alerts when we sign up to his Catalyst Cash-Outs LIVE weekly live stream for $149 upfront for the first year.

How To Turn JOLTS Into Overnight Gains

In today’s market, the only certainty is volatility.

However, on days the government releases economic reports, the volatility is way higher than usual and that's what Bryan's strategy seeks to exploit…like any good trader.

The JOLTS Loophole is a simple three-step system:

- Identify the next market-moving government report release date

- Place a JOLTS Loophole trade the day before

- Close the trade the day after the JOLTS report is released and count your overnight profits

On a typical day, the market only moves about .05%.

But over the past two years, on the 121 days the government released JOLTS reports, the moves have been 824% bigger.

So you could call this a macro-momentum strategy of sorts.

As for the ticker used in JOLTS Loophole trades, it's the same every time – SPY, the ETF of the S&P 500.

It seems simple enough – identify dates scheduled by the U.S. Government to release impactful economic reports, trade SPY for 24 hours, and profit.

However, after digging deeper, things aren't quite as easy as they seem.

What The Heck Are Zero-Day Options?

Bryan comes clean later in the teaser, saying that his trading strategy “combines a little-known trading technique with a brand-new type of investment.”

This “brand-new type of investment” is Zero Day Options or 0DTE.

True to their name, these types of option contracts expire on the same day they are traded and are “the secret to turning JOLTS into big payouts.”

Some have called them “options on steroids” and Bryan says they are “the only way to win when a stock moves big in either direction.”

But are zero-day options “the most stress-free way to trade options” as Bryan asserts, and what is the JOLTS Loophole track record to date?

Make 383% Overnight?

The teaser states that JOLTS trades “can hand us as much as 383% overnight.”

However, the average purported gain was 115% in 24 hours (winners and losers included), with an 83% win rate.

The caveat is that these are backtest results from 2023, not live trading results. Live results appear to be non-existent.

Since there are no expanded disclosures at the end of Bryan's teaser, this is all we have to go on.

So what Bryan is really asking, is for retail traders to test out a brand new intraday trading strategy, using the most volatile instruments in the market.

A Professional Trading Strategy

Searching around the web, I discovered that the JOLTS Loophole is not a new strategy.

It has been used as a macro-fundamental strategy by professional traders for years, albeit without the zero-day options part, just using volatile trading pairs.

From everything I gathered, the strategy has been pretty effective too. I didn't come across any hard figures, but since its been around in one variation or another, it can't be completely useless or pros would have stopped using it long ago.

However, it does seem to be losing its effectiveness.

One source concluded that “the US JOLTS Job Openings report may not always lead to significant market movements.”

Instead, understanding what data points the Federal Reserve is currently focused on will be significantly more volatile, because the Fed will be basing its interest rate decisions on that data release.

Bryan also alludes to trading other government releases in his teaser, saying that “48 different types of reports including inflation reports, export numbers, even Fed minutes are released throughout the year.” But this is only mentioned in passing.

Overall, any timing based strategies with highly technical setups aren't for me. Add in that fact that long-term results are unverifiable/non-existent, and the risk of losing 100% of my money trumps the potential reward of potentially making 383%.

There's a reason 70%-80% of intraday retail traders lose money and attempting to pull off strategies like this is why.

Quick Recap & Conclusion

- Professional trader Bryan Bottarelli is teasing a secret “Jolts Loophole” trading strategy that gives us a chance to collect as much as 383% overnight.

- JOLTS stands for Job Opening and Labor Turnover Survey and on the 121 days per year the government releases JOLTS reports, the market volatility has been 824% greater than the average trading day.

- Bryan's precise methodology is only broken down in a report called “The JOLTS Loophole: The Secret of HUGE Overnight Profits from Government Reports.” Its ours if we sign up to his Catalyst Cash-Outs LIVE weekly trading live stream for $149 upfront for the first year.

- The average purported gain of the strategy is 115% in 24 hours (winners and losers included), with an 83% win rate. However, these are 2023 backtest results and not actual live trades.

- 70%-80% of intraday retail traders lose money and until the JOLTS Loophole strategy can show live trading results over multiple years to the contrary, there is no reason to believe it is any different.

What is the best, proven intraday trading strategy you've come across? Let other readers know in the comments below.