According to Ian King, Apple is quietly working behind the scenes to fulfill it's co-founder, Steve Jobs' final vision.

Over the last few years, it's diverted hundreds of billions of dollars into something code named “Project Mulberry” and one little-known supplier stock is the key to making it a reality.

The Teaser

Mulberry isn't another device, app, or product. Instead it could “fundamentally change how we eat, sleep, and live.”

As a former institutional stock trader and hedge fund manager turned newsletter editor, Ian keeps the Wall Street to stock promoter pipeline going strong.

We have a good idea of what to expect here, as we recently reviewed his 3 Coins to Soar as Trump Legitimizes Crypto and AiPhone Stocks teasers.

However, the hype in this one is off the charts.

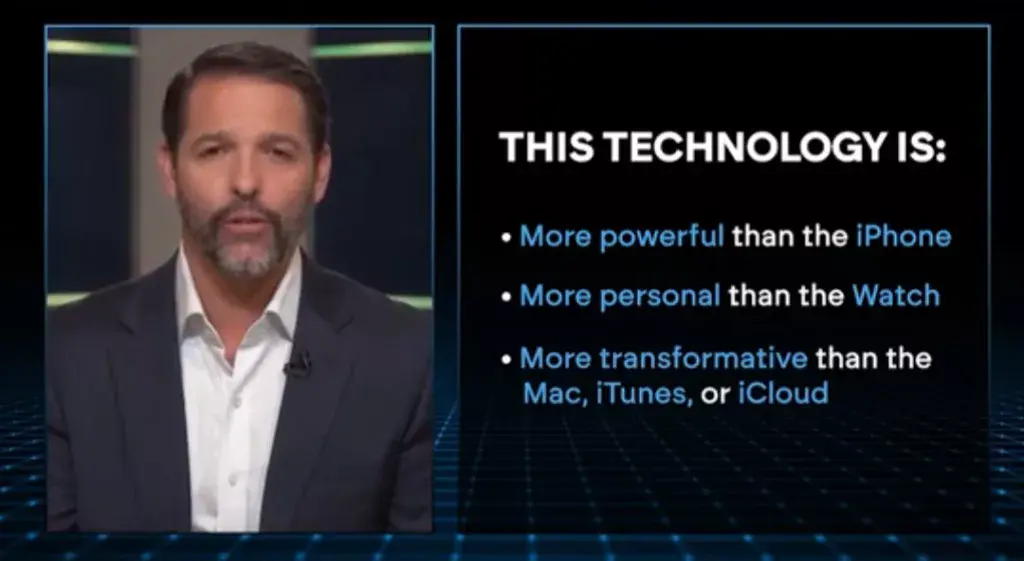

Barely a minute in and already the tech is made out to be otherworldly.

What is this profound innovation?

Ian calls it “the 4th great shift in computing,” after the personal computer, mobile phones, and cloud computing.

Ian's discombobulated video presentation eventually reveals it as “biological intelligence,” which is a combination of artificial intelligence and something more robust applied to healthcare, and its Steve Jobs final vision.

Jobs was a known advocate for alternative medicine, even eschewing conventional treatment for natural remedies until his final days.

If Apple stays true to this and becomes the first major corporation to break with the medical establishment, that would be revolutionary!

However, I'm not holding my breath.

Searching online, the latest is that Apple is due to launch “a groundbreaking health app called Project Mulberry sometime in the next year.”

The early prognosis is that it will leverage the Apple Watch and decades of consumer data that the company has on hand to create “tailored health services for users.”

But, it all hinges on one critical component from a specialist company that Apple has relied on for years.

The Pitch

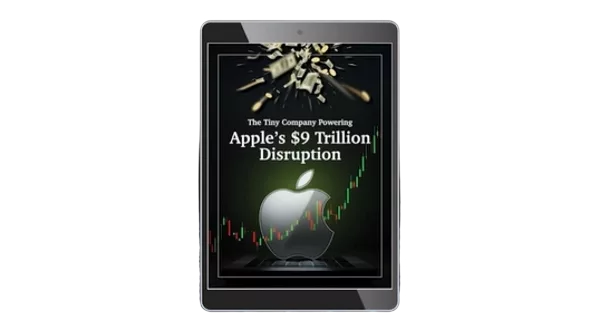

It's name and ticker symbol are only revealed in a new PDF report called The Tiny Company Powering Apple's $9 Trillion Disruption.

Nothing in life is really free though and that includes this report, as we will need a subscription to Banyan Hill Publishing's Strategic Fortunes newsletter to get our hands on it.

This will cost us $49 for the first three months.

What in the World is Biological Intelligence?

Apple's success formula is absurdly simple:

It's taken it from the brink of bankruptcy to a $3.5 trillion valuation.

Now, Apple is applying it's tried and true formula to the rapidly growing field of telemedicine. A $100 billion market that could grow to $1 trillion market over the next decade.

However, it's not about to roll out another fitness tracker app.

Instead, it's going one step further by tapping artificial intelligence to create a health intelligence ecosystem.

It's a new concept that experts say is actually four billion years old.

In layman's terms, biological intelligence is us and our DNA, the oldest operating system in the world.

Unlike AI, which makes machines smarter, BI makes us smarter by telling us things about our internal functions we wouldn't otherwise know.

Not only this, but it will take things a step further than today's health tracking apps by anticipating and detecting symptoms early.

Ian explains that Apple is better positioned to deliver a complete health experience than anyone else.

It's Apple Watch already doubles as a consumer health device and the iPhone's Apple Health stores and analyzes health and fitness data for those who opt into the service.

The upcoming iOS 19.4 operating system update expected next Spring will support AI health prompts and sensor inputs, which brings us back to the supplier stock that will help make “Project Mulberry” happen.

It's a chipmaker that will feed real-time signals to Apple's AI and it's Ian's pick to be the next in a line of breakout Apple supplier stocks.

Revealing Apple's Project Mulberry Supplier Stock

Ian hints at one supplier stock throughout the presentation. But nothing tangible is said until at least the 40-minute mark.

Here is what we have to work with:

- The company manufactures a chip no bigger than a grain of sand that is capable of tracking motion and orientation.

- Given the chips' compact size, it is also light on power consumption.

- It's upside potential is far greater than Apple's, with shares trading below $30.

There were a few possibilities here, but the limited clues we got led me directly to one name – STMicroelectronics N.V. (NYSE: STM). This is why we're so sure:

- STM launched a novel bio-sensing chip specifically for future healthcare wearables called the ST1VAFE3BX last October.

- The company touts the chips' enhanced performance and reduced power usage on its website.

- STM stock currently trades for just under $27, so it fits with Ian's sub-$30 figure.

Make 1,000% or More?

The boldface claim is that Apple's sensory chip supplier will get a 10-bagger bounce over the next decade, as Project Mulberry becomes a household product.

Ian isn't completely offbase here.

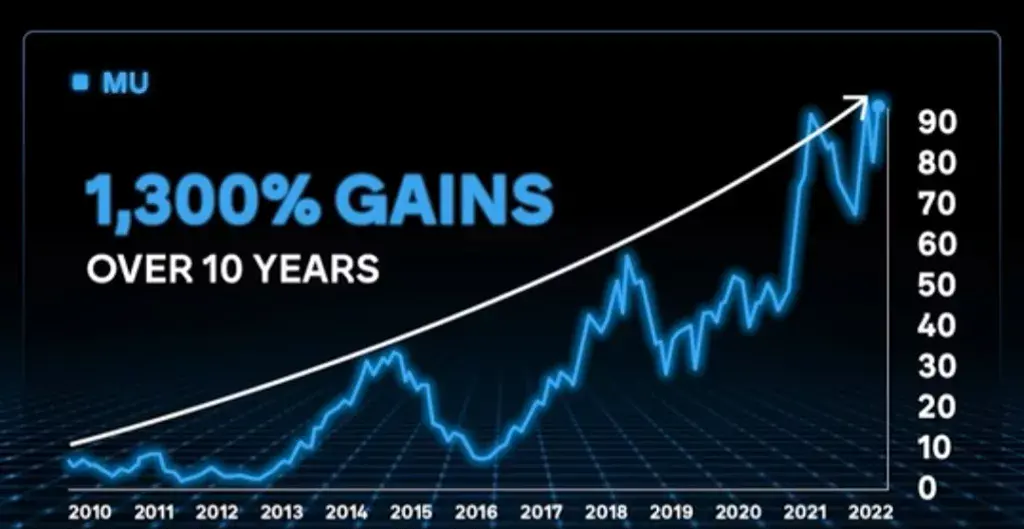

Apple suppliers like Micron Technology appreciated by 1,300% over ten years starting in the mid-2010s.

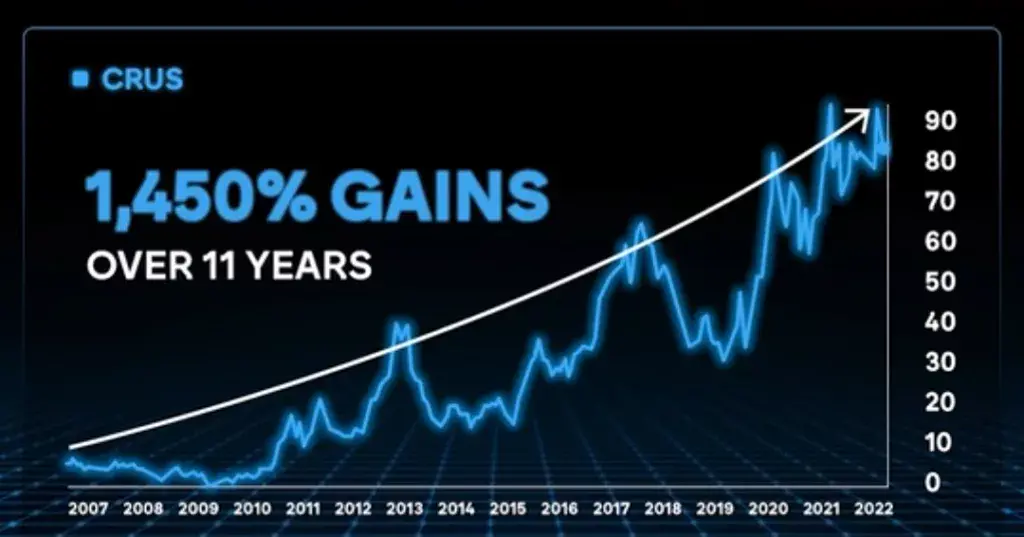

Integrated circuits supplier Cirrus Logic similarly notched a 1,400% gain over 11 years.

Will STMicro be next?

Based on its underlying fundamentals, no.

STM's 2% operating margin and 4% return on equity (ROE) leave a lot to be desired, and indicate no competitive advantage for our sensory chipmaker.

It is competing against the likes of Intel and TSMC after all.

However, it partially makes up for this with a low absolute valuation of less than 1.5x book and more potential upside given it's $23 billion market cap, which is a blip compared to much of its competition.

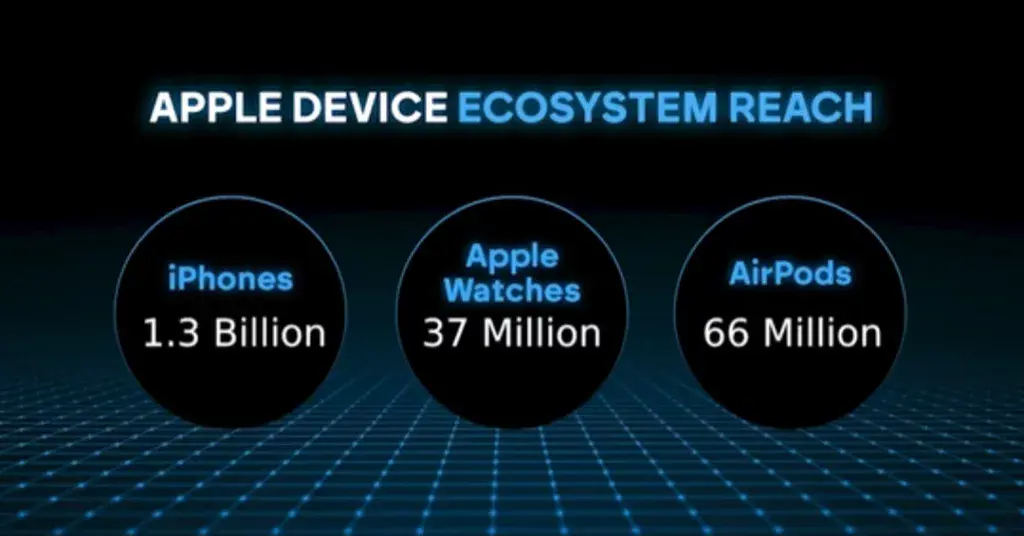

As for the Project Mulberry catalyst, Apple's distribution, touching nearly 1.4 billion people around the world is powerful, and a source of competitive advantage.

But it's not infallible.

If it was, we would be watching Apple TV, with a Vision Pro VR headset on, while wirelessly charging our devices with an AirPower charger.

Medicine is a highly personal thing. Speaking strictly for myself, I'm not jumping for joy at the chance to hand over sensitive health information to the largest consumer products company in the world, so that it can inundate my phone with alerts about what could happen to me if I miss the second to last step on the staircase.

Some will no doubt prefer it to a private physician or a less invasive health tracker, but many won't.

I'm not looking at Project Mulberry to make or break STM.

At best, it will give it a boost, unless we're talking about iPhone level of adoption, and I don't think we are.

At worst, it could fall if Apple ever ends up scraping the project.

STM looks more like a speculative bet than a surefire multi-bagger candidate.

Quick Recap & Conclusion

- Hedge fund manager turned newsletter editor Ian King is teasing Apple's Project Mulberry and more specifically, the little-known supplier stock that is the key to bringing it to life.

- Ian's discombobulated video presentation eventually reveals that Apple is working on “biological intelligence” by bringing together AI and sensory health data to anticipate and detect health symptoms early.

- The name and ticker symbol of the chipmaker feeding real-time signals to Apple's AI is only revealed in a new PDF report called The Tiny Company Powering Apple's $9 Trillion Disruption, which we need a subscription to Banyan Hill Publishing's Strategic Fortunes newsletter to access. This costs $49 for the first three months.

- Fortunately, you can skip forking over your cc info and the endless upsells, because we were able to reveal Ian's Project Mulberry supplier stock for free as STMicroelectronics N.V. (NYSE: STM).

- STM's new bio-sensing chip for wearables, ST1VAFE3BX, faces intense competition from larger chipmakers which is compressing margins and dwindling profits. Neither its low absolute valuation or the Project Mulberry catalyst are enough to make it a buy.

Would you allow Apple unfettered access to your private health data? Tell us where you stand in the comments.