Apple recently pulled back the curtain and let us in on part of their comprehensive AI strategy.

If history is any indication, massive disruption could follow, but according to The Motley Fool, there could be a smarter, savvier way to bet on the AI Revolution than just directly investing in Apple stock, that includes a “Trojan Horse” play.

The Teaser

The years 1984, 2001, 2007, and 2010 all have one thing in common.

But before we get to that thing, a word about the brains behind this email teaser.

The signature at the end of the email is from the Motley Fool's Senior Copywriter and Marketing Strategist, Sam Barker, who at least writes the copy for the stock pick teasers made by the Fool's analyst team.

Sam is also behind other Fool teasers, such as the “AI Disruption Playbook” Stocks and “Frozen Gold” LNG Stock, which we have previously reviewed here.

The one thing the years 1984, 2001, 2007, and 2010 mentioned at the top all have in common…they are the dates when Apple released market-defining products.

From the first Macintosh desktop computer released on January 24, 1984 to the iPod MP3 music player in 2001, the iPhone in 2007, and finally the iPad in 2010.

But these products also have another significant thing in common – they were not first to market.

Some company called the Kenbak Corp. released the first PC, MP3 players were already around since the late 90s, and Nokia, Motorola, and Blackberry, remember them? Were dominating the mobile phone market in the early 2000s.

This could be exactly what’s happening right now with Apple and AI.

Making AI Easy

Given its history, it could easily be argued that Apple doesn't just wait out it's competition.

It does so and then improves upon their functionality and design, making visually appealing, easy to use consumer products.

So while Microsoft, by way of it's $10 billion investment in ChatGPT creator OpenAI, Google, and Amazon all rushed to market with AI products. Apple bided its time and is now beginning to integrate “Apple Intelligence” into all of its market-leading consumer devices.

However, one small company providing “the backbone” behind Apple's technology could be the smarter, savvier way to bet on the AI Revolution.

The Pitch

The name of this company and its ticker symbol are only revealed inside an exclusive report called AI Supercycle: An Investor's Guide to the Artificial Intelligence Boom.

And the only way to get it is by becoming a Motley Fool Stock Advisor member.

This costs $99 for the first year and per The Fool, includes new stock picks every month, access to its “Top 10 Stocks to Buy Now” and a community of over half a million members.

A Radical, Magical Technology

So far this year, we have reviewed teasers covering just about every aspect of artificial intelligence.

From the energy AI consumes – as much as some countries, to the technology it requires to operate, which is advanced semiconductor chips.

Well, this teaser is about the machine tools needed to make the advanced semiconductor chips that AI runs on.

You can call it the tools that make the tech behind artificial intelligence.

The World's Most Critical Machine

One AI expert has called such highly specialized tools “the world's most critical technology.”

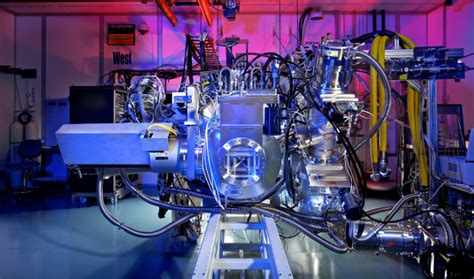

Officially, its known as an EUV lithography tool and without it, making advanced AI chips is simply impossible.

So it's not just Apple Intelligence that requires it, but any company that wants to create its own, proprietary large language AI models.

To keep it short and simple, lithography is the process of using light to create patterns on silicon wafers.

We're talking about light smaller than the wavelength of visible light.

Humans can't even see objects smaller than the wave length of light under a traditional microscope.

As you can probably tell, pulling this feat off is complicated, difficult, and expensive.

It's why only a handful of companies the world over have the precision capabilities necessary to manufacture the tools that produce it, at scale.

One of these companies is an “under the radar AI behemoth that is a fraction of the size of Apple” and it's The Fool's “Trojan Horse” play. Let's find out what it is.

Revealing The Motley Fool's Trojan Horse Apple AI Play

The Fool's email teaser doesn't give us much in the way of clues:

- A business 8x smaller than Apple

- Provides the technology behind powerful AI components

However, it did point us in the right direction by referencing a Verge article from 2023 that said “semiconductor manufacturers are wholly dependent on this one tiny company.”

This led us directly to ASML Holding N.V. (Nasdaq: ASML). Here is how the clues line up:

- At a current market cap of $358 billion, ASML is by no means a “tiny company“, but it is about 8x smaller than Apple's present $3.4 Trillion valuation.

- ASML provides the world's leading chipmakers with the tools necessary to mass produce patterns on silicon, helping to make computer chips smaller and faster.

- The Verge articles cites Apple, Nvidia, and AMD, among others, as being “wholly dependent” on TSMC, which is in turn wholly dependent on ASML.

The Best Way to Make A Fortune From AI?

ASML has something going for it that very few other businesses do:

A near monopoly in a well-defined niche.

By most accounts, ASML has an 83% stranglehold on the extreme ultraviolet (EUV) lithography space.

This makes it a defendable, high margin (26.5%), free cash-flowing ($3.5 billion in fiscal year 2023) business.

For the reasons just mentioned, shares are not cheap, trading for 46x trailing earnings and over 100x free cash flow.

However, even at its present valuation, ASML still has lots of room left to grow.

The conflagaration and rapid growth of mobile communications, data centers, and artificial intelligence, which ASML indirectly enables by making the tools that make advanced chips, will keep the business growing by more than 27% annually, as it has over the past five years.

As an added bonus, ASML also pays a small, albeit growing, annual dividend of just under 1%.

This makes it a moonshot investment with the characteristics of a royalty trust, which produces consistent cash flow year after year, and one of the best ways to play AI.

Quick Recap & Conclusion

- The Motley Fool is teasing a smarter, savvier way to bet on the AI Revolution than just directly investing in Apple stock, that is also a “Trojan Horse” play.

- Apple has begun integrating “Apple Intelligence” into all of its market-leading consumer devices and one company is “the backbone” behind Apple's technology.

- The name of this company and its ticker symbol are only revealed inside an exclusive report called AI Supercycle: An Investor's Guide to the Artificial Intelligence Boom. However, you have to be a member of The Motley Fool's Stock Advisor community to get it, which costs $99 to join for new members.

- We revealed the pick inside the exclusive report for free in this review as ASML Holding N.V. (Nasdaq: ASML).

- ASML is a defendable, near monopoly in a well-defined niche with lots of room to grow due to macroeconomic headwinds, making it one of the best ways to play AI.

Is ASML the best AI play in the market? Let us know your thoughts in the comments.

Yes it could be