The #1 performing commodity on Earth in 2025 is not gold.

It's rarer, harder to mine, far more versatile, and a pair of “Ghost Metal Miners” are the best way to profit from it.

The Teaser

According to Angel Publishing, this metal quietly catalyzes the modern world.

Angel is the investment newsletter publisher behind the likes of Brian Hicks, Bitcoin Loophole, and Keith Kohl, #1 Nuclear Stock, whose teasers we have regularly reviewed here.

In this particular presentation called The Ghost Metal's Revenge, like a horror slasher flick, Angel's in-house editors are hyping up a critical invisible metal.

We already know its not gold, but its not silver, copper, or lithium either, and it has outperformed all of them this year.

What's more, this “ghost metal” is in a record supply deficit, the deepest in its history.

High demand, low supply, a rising price, it sounds like an ideal investment setup, so what is it?

Angel is talking about none other than Platinum.

A Super Squeeze

Appreciated yet overlooked is a good way to describe the rare precious metal known as platinum.

The global auto, jewelry, and hydrogen industries all basically run on it, but most investors have never given much thought to making it a staple in their portfolios.

By the looks of it, now may be a good time start.

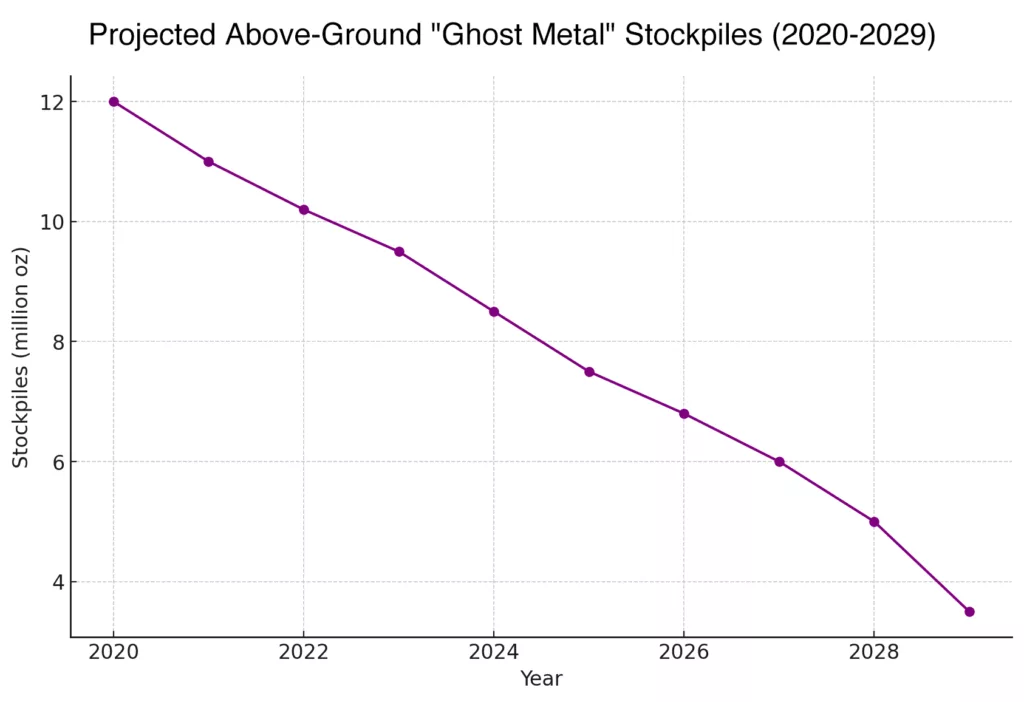

Per Sprott, current platinum inventories are barely enough to cover six months of demand.

Should this persist, global stockpiles could be completely exhausted by 2029.

Things aren't looking much better on the production side either, with mines in South Africa, the world's largest producer, running 5-15% below capacity due to political challenges, to put it nicely.

Couple this with no major new mines set to come online, limited recycling, and supply is completely choked despite rising prices.

However, Angel Publishing believes there are even better ways to play the platinum trade than purchasing it outright.

It has zeroed in on two tiny companies that control “the crown jewels of the Ghost Metal supply.”

The Pitch

Both names and tickers are revealed in a new intelligence briefing called The Ghost Metal's Revenge: 2 Tiny Stocks Set to Soar as the World Runs Out of This Critical Mineral.

The briefing, which comes with two bonus reports, is a limited time package that can be purchased directly for $99, no subscription, no refunds.

The Tipping Point

At the same time supply collapses and production is strained, demand is exploding.

The setup in platinum today is eerily similar to some of the biggest metal rallies of the past few decades.

Take for example silver, which was languishing around $15 an ounce in 2010.

But then inventories tightened, demand spike, and boom! Silver was $50 an ounce within a year.

Or more recently, palladium, which traded under $600 an ounce in 2016.

Then above-ground inventories began to dwindle and by 2021, palladium smashed through the $3,000 an ounce price barrier.

Now consider platinum.

It's industrial base is larger than palladium, used in agricultural fertilizers, medical pacemakers and defibrillators, and glass manufacturing, among other essential uses.

It is also in its third straight year of supply deficits, with mine output expected to drop a further 5% this year.

This is bigger and deeper than palladium's crunch ever was and it could get worse before it gets better.

A Wild Card

Angel Publishing also throws out a potential wild card…

Given the unreliability of South Africa and Russia, the world's second largest platinum producer, the rare metal is now on Washington's radar as a critical mineral.

This means tariffs, quotas, or outright bans on foreign supply could come with the stroke of a pen.

Should this go down, domestic U.S. miners with platinum stockpiles could see their reserves revalued overnight.

I would also add that prior to 2011, platinum has historically been more expensive than gold. Currently the ratio sits at 2.4x gold to platinum.

So by every metric imaginable, platinum appears undervalued and could be at a tipping point.

But what about the two platinum miners that Angel is teasing?

Revealing Angel Publishing's Ghost Metal Miners

Unlike some previous Angel Publishing teasers, we get some quality clues about the two picks.

Ghost Miner #1

- It's the only known significant source of platinum in the entire U.S.

- Last year it produced 1.3 million ounces of the metal.

- Besides it's U.S. operations, the company controls a 48 million ounce reserve in South Africa plus a massive recycling business that reclaims platinum and other precious resources from electronic and industrial scrap.

Based on the first clue Sibanye-Stillwater Limited (NYSE: SBSW) is the pick.

- SBSW owns the Stillwater Complex in Montana. The most significant source of platinum in the U.S.

- The company produced about 1.3 million ounces of platinum last year and about 1.7 million ounces of platinum group metals (PGMs) overall.

- Sibanye's combined South African operations total about 39 million precious metal mineral reserves, with a sizeable metals recycling operation.

Ghost Miner #2

- The second company sits on the largest platinum resource base on Earth.

- It has over 600 million ounces in reserves, which is the equivalent of nearly 8 years of total global demand at today's consumption rates.

- Annual production is expected to be over 3 million ounces and it trades for under $10.

Valterra Platinum Limited (OTC: ANGPY) formerly known as Anglo American Platinum, is the second “ghost metal miner” stock.

- Valterra owns the largest platinum resource base on Earth, the Bushveld Complex in South Africa.

- The miner's resource base exceeds 600 million ounces and it's stock trades just above $11, after a 126% run up so far this year.

The Perfect Asymmetric Plays?

Angel Publishing plays up it's picks, saying:

The ghost metal stocks offer balanced exposure to what could be the most explosive asymmetric opportunity in the metals market today.

I like a solid asset play with steady income, and the opportunity for significant appreciation, but is that what we would be getting here?

Sibanye-Stillwater: One way to value a miner that isn't producing consistent cash flow, but has substantial reserves is Price/Net Asset Value (NAV).

If we run the numbers on Sibanye, it's NAV is just above $13, which is ever-so-slightly higher than it's stock price today, so it's fairly valued at today's platinum price. There is upside here.

Valterra Platinum: The company is earnings-positive, pays a small dividend, and it's reserves are massive, totaling over $300 per share!

At a current market price of $12, the risk/reward is decidedly in our favor.

Quick Recap & Conclusion

- Angel Publishing is teasing a commodity that is rarer, harder to mine, far more versatile than gold, and a pair of “Ghost Metal Miners” are the best way to profit from it.

- The commodity is platinum, whose existing supply is dwindling, production is strained, and demand is exploding.

- Both “ghost metal miners” are revealed only in a new intelligence brief called The Ghost Metal's Revenge: 2 Tiny Stocks Set to Soar as the World Runs Out of This Critical Mineral. It is ours if we pony up a one-time payment of $99.

- Fortunately, Greenbull readers can keep their wallets in their pockets as we were able to reveal both “ghost metal miners” for free. The first is Sibanye-Stillwater Limited (NYSE: SBSW) and the second is Valterra Platinum Limited (OTC: ANGPY).

- Sibanye-Stillwater has upside potential and Valterra (formerly Anglo American Platinum) is a solid hard asset play. Neither are perfect, but both are asymmetrical bets.

Will platinum return to a 1:1 ratio with gold? Let us know what you think in the comments.