For the first time ever, a national wealth fund is being created, and it could lead to the biggest dividend in U.S. History.

One of the things that is going to power it is “Oil & Gas Royalty Checks,” which you can start collecting right now!

The Teaser

In Texas, oil royalties are called “mailbox money” because every month, like clockwork, a check arrives in the mail. Trump has a plan to expand mailbox money to the entire nation.

How is he going to do it?

Independent investment research company Angel Publishing thinks it has the answer. It has had a busy year thus far, churning out regular teasers for their paid newsletters.

We have reviewed some of the spicier ones, including Bill Gates’ $4 billion “Natrium” AI Bet and Keith Kohl’s “AI Equity Checks.”

The answer to how Trump will make mailbox money a national thing is sovereign wealth.

More precisely, a sovereign wealth fund that builds national wealth, funds government operations without having to rely on income taxes, and pays dividends to citizens.

That sounds awesome, like an American eagle riding a stallion against a backdrop of snow-capped mountains. But is it doable?

Plenty of examples abound, from Norway, which has the largest sovereign wealth fund in the world with assets worth more than $1.8 trillion. To China's Investment Corp., which is aggressively acquiring strategic assets worldwide, and Saudi Arabia's Public Investment Fund, which buys soccer players.

However, the best example may be Alaska!?

Wealth And Dividends

Ten years after Alaska became a U.S. state in 1959, it struck oil, and locals made a very wise choice.

They got together and voted to create a fund to invest the state's oil proceeds for future generations. Thus, the Alaska Permanent Fund was born with a unique two-pillar structure consisting of a Principal, which is permanent savings, and an Earnings Reserve Account that is available to spend.

Today, it owns assets worth more than $83 billion, and every year it sends residents a tidy dividend check, which last year came out to $1,400.

Now, Trump is applying this same model to America’s untapped wealth, and one oil and gas royalty opportunity is at the center of it.

The Pitch

Angel Publishing has put together a new report revealing its name, called: “Trump's Secret Fund: How to Collect Passive Income From America's Hidden Wealth”

Unlike most teasers that look to set up the sale of a long-term subscription, Angel Publishing is trying something different with this one.

It is selling the report itself for $99. No subscription, recurring fees, and no refunds.

The Real Value of America's Hidden Wealth

Before we reveal the oil and gas royalty play, there's one part of the teaser that caught my attention.

It's more of a fun exercise than anything…

What do you estimate all of America's nationally-owned assets are worth?

There are the Fort Knox gold reserves, which are supposed to represent half of the country's total reserves. 147.3 million ounces at more than $3,200 a pop is about $476 billion. Times this figure by two, and that's $953 billion.

Next up is federal land. The consensus is that the federal government owns anywhere from 620-640 million acres of land, or around 27-28% of the entire country.

These publicly-owned lands were supposedly valued at $1.8 trillion in 2015 by the U.S. Department of Commerce's Bureau of Economic Analysis. That's a decade ago, so safe to assume they are worth substantially more now.

Rounding this out are untapped rare earth minerals, oil, and gas reserves. The National Mining Association did a rough back-of-the-envelope estimate of their value in 2017 and came up with a figure of $6.2 trillion.

There's also other stuff, like tariff revenue, Bitcoin reserves, and investment income from U.S. Treasury-owned assets, but it's too early to get a proper estimate on the first two.

In any case, even at badly outdated estimates, these untapped assets would be enough to create the world's largest sovereign wealth fund.

It wouldn't solve America's debt or deficit woes overnight, but it would be a good start, and less government dependence on tax revenue would be a net benefit for everyone.

Now, let's find out about what Angel calls “one of the income streams that will power the sovereign wealth fund.”

Revealing Angel Publishing's #1 Oil & Gas Royalty

Here is everything we know about this “mailbox money” play:

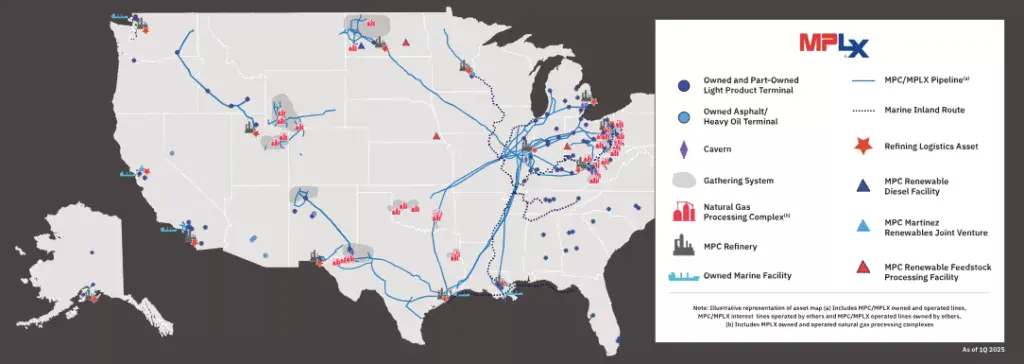

- It owns 13,000 miles worth of pipelines across America.

- Over the past 12 months, this company raked in $11.1 billion in revenue from transporting a massive percentage of U.S. oil and natural gas output.

- Shares go for around $50, and it recently raised its dividend to a whopping 7.24% annual yield.

This was a tough one, as several companies have components that fit this description. But in the end, MPLX LP (NYSE: MPLX) looks to be the play.

- The master limited partnership's pipeline network includes over 13,000 miles throughout the continental United States and Alaska.

- MPLX's revenue over the past twelve months was exactly $11.1 billion.

- Shares currently go for just over $51, and its current dividend yield is 7.38%.

The Perfect Investment?

Longtime readers know how I feel about royalty investments.

For those who don't know, Warren Buffett said it best: “The first rule of investing is to never lose money.” It's pretty hard to lose money investing in a business that just collects a royalty on the production of another.

There aren't many businesses that have a net profit margin near 40%, with a 7% annual dividend, that are selling for a price/earnings of less than 12x.

Still, MPLX isn't a pure-play royalty trust, it is a hybrid with passively owned assets and active operations. So this isn't “the perfect investment,” and it carries more risk than a typical royalty stock, where the only real danger is making sure the owned assets don't run dry anytime soon.

This isn't a concern with MPLX, as it owns a diversified array of midstream energy infrastructure and logistics assets across the country.

The other worry with royalty stocks is growth and not just owning a terminally depreciating asset.

MPLX is good to go here as well. It is actively expanding its existing pipelines and making bolt-on acquisitions, like the recent BANGL pipeline system pick up from WhiteWater and Diamondback Energy, which are immediately accretive to earnings.

Finally, there is some concern about MPLX's $22 billion in total debt, but debt/equity is stable at 1.6x, for now.

Overall, there are less-leveraged, pure royalty trusts available. But MPLX's diversified mix of producing assets, which are growing, and low absolute valuation still make it an attractive investment.

Quick Recap & Conclusion

- For the first time in American history, a sovereign wealth fund is being created, and according to Angel Publishing, one of the things powering it will be “Oil & Gas Royalty Checks.”

- Trump has signed an executive order directing the creation of a sovereign wealth fund. No word on what assets will be included, but Angel is confident oil and gas will be at the center of it.

- A new report called “Trump's Secret Fund: How to Collect Passive Income From America's Hidden Wealth” reveals the name of Angel's #1 Oil & Gas Royalty Play. Unlike other teasers, it is It is selling the report itself for $99. No subscription, recurring fees, and no refunds.

- There were lots of contenders, but we were able to reveal Angel's #1 pick for free as MPLX LP (NYSE: MPLX).

- MPLX is a master limited partnership with a mix of passive and operating assets, so it is not a true royalty stock. However, its diversified mix of assets and low absolute valuation, with a high dividend, make it a respectable pick.

What is your favorite royalty play? Drop the ticker in the comments.