James Altucher called the election, correctly predicting a Trump win.

Now, he's saying that it's only the beginning of a massive crypto melt-up that will last the next four years, but the biggest opportunity isn't in Bitcoin, it's in a set of “Five Coins for the Election Melt-Up.”

The Teaser

Trump promised friendly crypto regulations. That’s why the market popped in anticipation before he was even sworn into office.

Renaissance man James Altucher has been on about Bitcoin since 2013, when it was trading for just $114. So, he's as close to an expert as there is and not some Satoshi-come-lately just jumping on the bandwagon.

We have previously reviewed his “Coiled Crypto” Recommendations and AI 2.0 Stock teasers.

In this teaser, Phil Stone plays host, while James goes through his spiel.

It starts off with James saying that “Trump is going to help unleash a giant new crypto opportunity that will be worth as much as $100 trillion by 2030.”

The figure ($100 trillion) he throws out is bigger than Bitcoin and even larger than the entire U.S. economy, four times over, so what crypto trend could be this monumental?

The Next Big Thing in Crypto

First there was Bitcoin in 2013.

Then came altcoins in 2017 and the last big trend in crypto was staking coins in 2019.

Every one of these times was an opportunity to turn $1,000 into as much as $400,000 by investing in the right coins.

For example, a $1,000 stake in a coin called Terra in 2019, would have netted us $260,000 in little more than two years.

That's more than a 20,000% gain!

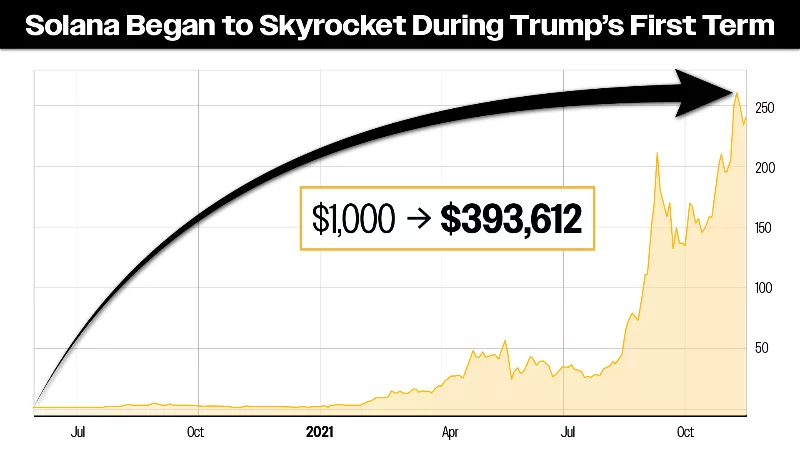

Another well-known coin called Solana launched in early 2020, would have turned $1k into almost $400,000 in less than two years.

Now, through friendly regulations and a strategic national Bitcoin stockpile that will never be sold, Trump has laid the groundwork for crypto's biggest run-up yet.

The biggest banks on Wall Street are betting their future on this new crypto trend, and the former president of the New York Stock Exchange, Tom Farlye, said it will “rewire all financial services.”

Mastercard and Visa are in on it too.

Folks, James is talking about something called tokenization, and he's found five coins at the center of this blistering hot new trend.

The Pitch

All of the names are revealed in a report called The Top Five Coins for the Coming Election Melt Up.

It is ours if we become members of James's flagship crypto research service, The Early-Stage Crypto Investor.

The cost for the first year is $1,995 (normally $5,000) and it comes with a Double Satisfaction Guarantee. Meaning we can get a full refund during the first 90 days or an extra year of free access if we cancel at any time during the next 12 months.

Tokenization is ready for Prime Time

The CEO of the new vampire squid, Blackrock, Larry Fink, made a startling statement while speaking at a public event:

The next generation for markets, the next generation for securities, will be tokenization of securities

Remember, this is the same guy who once doubted Bitcoin's legitimacy.

It appears he's realized the error of his ways and now recognizes the power of the (block)chain.

As McKinsey & Co. puts it, tokenization is the process of creating a digital representation of a real thing.

The equivalent of securing a sensitive data element with a non-sensitive element, and it's rapidly gaining traction.

The total market value of tokenized real-world assets (RWAs) on public blockchains currently sits at around $22 billion, up from about $10 billion just last year.

Institutions are now on board, with BlackRock’s BUIDL fund holding $2.9 billion in tokenized U.S. Treasuries, making it the largest tokenized asset fund in the world.

Old vampire squid Goldman Sachs has also tokenized US Treasury bonds, Citibank is testing tokenizing deposits, and even Trump’s family has launched a new business that will tokenize real estate assets.

Moving assets onto the blockchain makes them more secure, and it makes transactions cheaper and faster than through the traditional interbank system.

This is where the opportunity comes in, as incumbent financial institutions need to collaborate with blockchain technology platforms that make tokenization possible, and James believes he's found the top five projects behind this mega-trend.

Revealing James Altucher's Five Coins for the Election Melt-Up

These projects are building the infrastructure for the tokenization trend.

The first coin is a project that specializes in connecting data to blockchains, which James offers up as a freebie to incentivize more subscriptions.

It's Chainlink (LINK).

As for the rest, one or two clues are offered up for each.

The Second Melt-Up Coin

- It provides the tokenization infrastructure for asset managers to digitize, manage, and distribute funds on the blockchain.

- They’re already tokenizing Treasury bonds and it's coin is trading for under 50 cents.

This sounds like Ondo Finance (ONDO).

- Ondo's public ledger is actively facilitating tokenized U.S. Treasury Bond transactions.

- The Ondo coin currently trades for around $0.77.

The Third Melt-Up Coin

- It is using tokenization technology to transform the supply chain industry by turning supply chain data into tokens.

- The likes of Costco, Walmart, Target, and the Home Depot are already using it.

This one is tougher to nail down, but VeChain (VET) fits the description.

- VeChain is a smart contract platform that has been applied to improve supply chain transparency by Walmart China, among others.

The Fourth Melt-Up Coin

- This coin is targeting the multi-trillion dollar derivatives market, and it is trading below $2.

Not much to go on, but Ripple (XRP) has to be the pick here.

- XRP is synonymous with financial market tokenization, and the coin currently trades just above $2.

Unfortunately, no clues were provided on the elusive fifth coin, which remains a mystery.

Last Chance to Turn $1,000 into $400,000?

James' teaser is an asymmetric bet.

So even if Trump’s crypto-friendly initiatives and the institutional adoption of tokenization fail to stoke the speculative juices of the masses over the short-term. A $1,000 bet in tangible coins with real-world applications will return more than we stand to lose over the long term.

Most of the picks, with the notable exception of XRP, which is already up some 360% this year, have failed to melt up post-election, as James predicted.

However, I would argue that a coin like Chainlink, which enables universally connected smart contracts that are becoming the gold standard for security, will be much more valuable a few years from now.

When it comes to Altucher's Early-Stage Crypto Investor research service, 60% (775/1,300) of members responding to a survey said that, since subscribing, their portfolio has gone up by 0-10%.

Turning $1k into $400k (a 40,000% return) over any time frame is insane. But if anything can do it, crypto can, as it's already proven.

So, overall, a useful teaser from a credible presenter, with a newsletter that has delivered at least average results.

Quick Recap & Conclusion

- James Altucher is predicting a massive crypto melt-up that will last the next four years.

- However, the biggest beneficiaries will be five coins in the rapidly emerging tokenization niche.

- All of the names are revealed only in a report called The Top Five Coins for the Coming Election Melt Up. It can be ours if we subscribe to James's flagship crypto research service, The Early-Stage Crypto Investor, at a cost of $1,995 for the first year.

- Fortunately, we were able to name four out of five of James' picks for free. They are Chainlink (LINK), Ondo Finance (ONDO), VeChain (VET), and Ripple (XRP).

- James' teaser is an asymmetric bet, meaning that a $1,000 investment in tangible coins at the forefront of tokenization will return more than we stand to lose over the long term.

Is tokenization the next frontier for financial markets? Let us know your thoughts in the comments.