The biggest change to the U.S. Dollar in over a century is now underway.

A brand new form of money Addison Wiggin is calling “Dollar 2.0” has already been signed into law and a small group of companies at the center of it could become the most powerful institutions on the planet.

The Teaser

Control the money, control the world.

Addison Wiggin is dedicated to covering profitable financial stories as a writer, publisher, and filmmaker, with three decades of financial publishing experience for the likes of The Daily Reckoning and investment newsletter grandaddy, Agora Financial.

We have previously reviewed his #1 Uranium Stock and “Social Security X” Picks.

Unbeknownst to many, since the public education system doesn't teach it, money, and more specifically how it is created, has a profound impact on our daily lives.

Inserting the old Henry Ford quote about the banking system is appropriate here:

Perhaps the most insidious way it affects us is through something we do hear a lot about, inflation.

Some would have us believe that inflation is rising prices, but rising prices are just a symptom of inflation, not the underlying cause.

Inflation is an increase in the money supply.

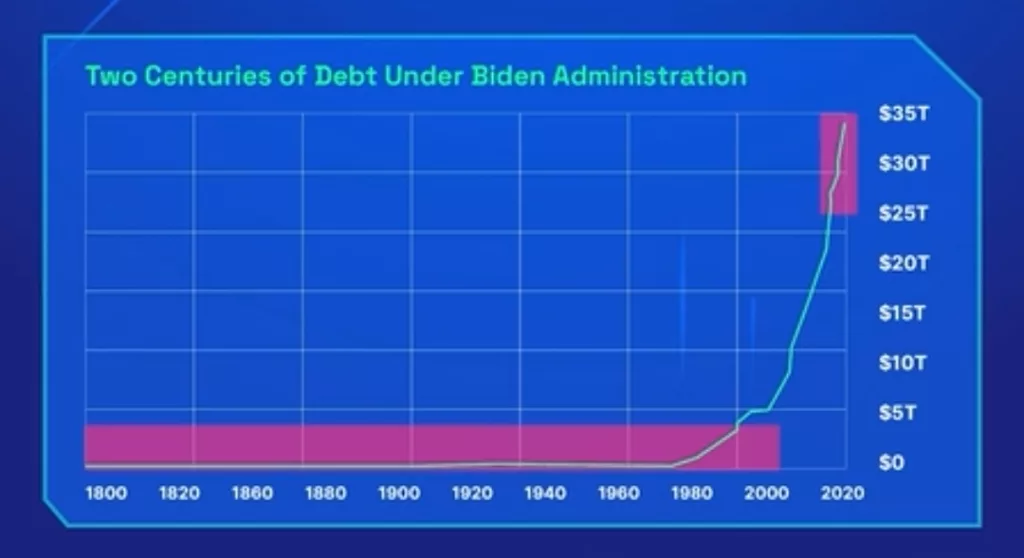

Since 2020, this figure has gone completely parabolic, with more than 20% of all dollars in existence printed since then:

History is clear: No purely fiat, unpegged currency has ever survived to see it's 100th birthday without collapsing.

The likes of the USD and the British Pound have now been decoupled from gold for the better part of half-a-century and are getting a little long in the tooth.

S.1582

One of the only solutions is to create a “Dollar 2.0.”

Enter S.1582, better known as The Genius Act.

Legalizing stablecoins may not sound like a big deal, but it could be what ultimately ends up saving America from a debt death spiral, and make those who are in the know rich.

The Pitch

All of the ways to profit from “Dollar 2.0” have been included in a special report called 3 Stocks Driving America's Dollar 2.0 Revolution.

To get it, we'll need to become members of Addison's Grey Swan Investment Fraternity for a price of $49 for the first three months ($99 quarterly thereafter).

The Stablecoin Shock

It's 1974, Hank Aaron just broke Babe Ruth's home run record, a cheeseburger at McDonald's costs 33 cents, and the Nixon oil shock made oil prices quadruple.

The dollar, which had also recently been decoupled from gold in 1971, was in a world of trouble.

If it wasn't for an eleventh hour deal struck with Saudia Arabia that guaranteed military protection in exchange for pricing all oil exports in USD, the dollar may have died a long time ago.

Today, the USD finds itself in a similar predicament.

Debt is impossibly high, interest payments on the debt are going up due to lack of demand for it, and devaluation is accelerating.

But what if there was a way to create demand for dollars/treasuries, slash interest payments, and make money, all without needing to cut a deal with a third-party?

Legalizing stablecoins to function as a digital medium of exchange and mandating that they are backed by cash and treasuries is seen as a way to accomplish this.

A $2 Trillion-Dollar Market

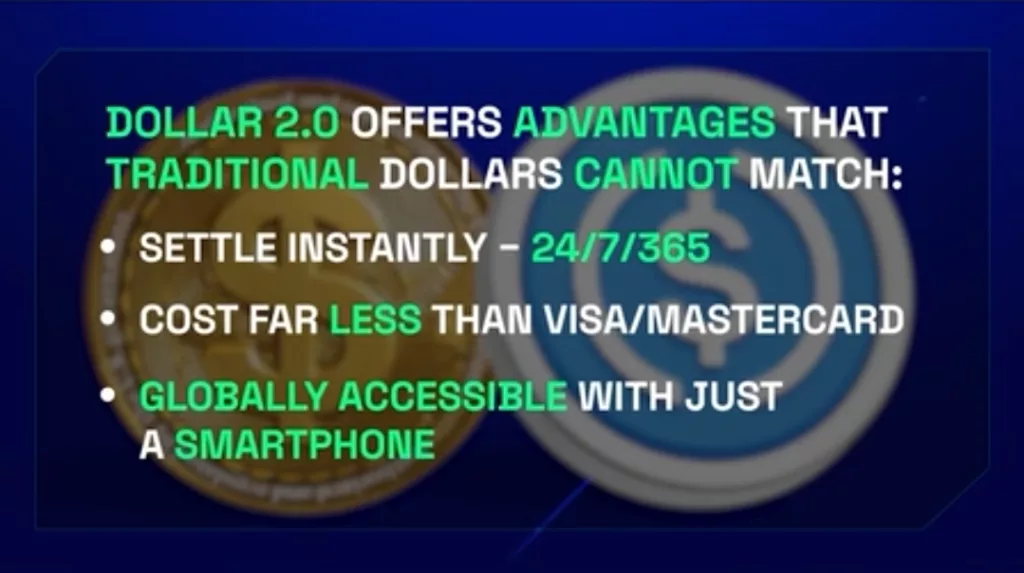

Unlike most digital assets whose value and utility is tied to certain platforms, stablecoins offer one major difference…

They can be used to make payments.

Technically, any digital asset can be used for payment, but network speed and volatility keeps this from being practical.

Can you imagine using Bitcoin to pay for an invoice and the outstanding value of it changing by thousands of dollars within minutes or hours.

Stablecoins solve this prickly problem due to their value being pegged 1:1 with the USD, among other benefits:

This is the primary reason stablecoins are now a $300 billion market, with some projecting massive growth of more than 250% annually going forward.

If the oil shock nearly collapsed the dollar in the 70s, the stablecoin shock could breathe new life into it and since stablecoins are issued by private companies, not a central bank, we can profit from it too.

Revealing Addison Wiggin's “Dollar 2.0” Stocks

Addison is calling his picks the “U.S. Digital Reserve” because just like the Federal Reserve before, they can mint new digital dollars.

The only difference is this time around we, the people, benefit, instead of central banksters.

Three companies are at the heart of it, starting with…

The Most Important Company in the Dollar 2.0 Rollout

- It helped build the rails that the Dollar 2.0 runs on.

- This company is also a custodian for billions of 2.0 dollars.

This seems to hint at Coinbase Global Inc. (Nasdaq: COIN).

- Coinbase didn't help build the underlying blockchain that stablecoins run on, but it did launch a full-stack stablecoin payment service to enable faster settlement.

- Coinbase Custody is one of the largest custodians of stablecoins.

The Berkshire Hathaway of Dollar 2.0

- This company owns equity stakes in many stablecoin infrastructure businesses.

- It also offers a full-service platform when it comes to trading, lending, market-making, and data centers.

Galaxy Digital (Nasdaq: GLXY) sounds like the pick here.

- Galaxy led a Series A funding round for Rail in 2024, invested in the Terra stablecoin ecosystem, and launched Galaxy Ventures Fund I last year to invest in stablecoin startups.

- The firm owns a $2 billion book of loans, is a global liquidity provider, and operates the Helios AI data center campus.

The Company Minting Dollar 2.0

- The final pick creates the Dollar 2.0 itself.

- It has partnerships in place with the likes of Goldman Sachs, Fidelity Investments, and BlackRock.

This was the easiest pick of all, it's Circle Internet Group (NYSE: CRCL).

- Circle is the issuer of the second-largest stablecoin in the world, USDC.

- Goldman Sachs is a Circle shareholder, as are Fidelity and BlackRock.

Dollar 2.0 Revolution or Downfall?

To use a football analogy, we're at the end of the game, losing by a touchdown, and have the ball at midfield.

A hail mary and hope is the only option.

This is what “Dollar 2.0” feels like.

If it doesn't work, the game could be lost, and a USD alternative could be adopted.

Fortunately, short of a World War, I don't see that happening, and any baby step away from central bank control is a move in the right direction.

Stablecoins already hold a rising share of the multi-trillion-dollar cross-border transaction market and adoption is also growing stateside.

From a practical use standpoint, who doesn't want frictionless transactions that cost less and settle instantly?

The investment case is equivalent to owning banks and payment infrastructure at the beginning of the last century. A solid bet.

I like Coinbase, Galaxy Digital, and Circle a lot more after their recent 30% dips.

Coinbase offers some of the best value at only 13x current earnings, but Galaxy Digital and Circle offer far greater upside over the long-term, if you're willing to pay a bit more upfront.

Quick Recap & Conclusion

- A brand new form of money Addison Wiggin is calling “Dollar 2.0” has been signed into law and a small group of companies are at the center of it.

- Addison is talking about Stablecoins, which are backed 1:1 by dollars and treasuries.

- The best ways to profit from stablecoins have been included in a special report called 3 Stocks Driving America's Dollar 2.0 Revolution. It's ours with a subscription to Addison's Grey Swan Investment Fraternity which costs $49 for the first three months and $99 quarterly thereafter.

- We got enough clues to reveal all three of Addison's “Dollar 2.0” picks for free: Coinbase Global Inc. (Nasdaq: COIN), Galaxy Digital (Nasdaq: GLXY), and Circle Internet Group (NYSE: CRCL).

- Coinbase looks like a relative bargain, but Galaxy Digital and Circle are better long-term growth bets.

Have you used a stablecoin yet? Tell us about it in the comments.