What do Texas state representatives, energy specialists from Australia, and George W. Bush all have in common?

They are all after what Addison Wiggin calls a “Silvery-White Metal.” That's because it equals opportunity and money; one under-the-radar uranium stock is the key to profiting from it.

The Teaser

A huge new boom is about to get underway across Texas, except this time, it's not the usual suspects of oil and natural gas creating it.

Instead, it's fueled by this “Silvery-White Metal” that looks more like chrome spray paint from Mad Max: Fury Road.

Addison Wiggin is a longtime financial commentator, co-founding The Daily Reckoning website before starting up the Grey Swan “investment fraternity” last year to “provide essential tools for investors seeking to navigate an increasingly polarized world.”

We have recently reviewed other resource-related teasers, such as Garrett Goggin’s “Golden Anomaly” Gold Miner Picks, and Nick Giambruno’s #1 Gold Stock (“QE Infinity”).

Alright, so what exactly is making Texas richer?

Addison explains that oil created the first wave of generational Texas wealth. Names like H.L. Hunt, Clint Murchison, Sid Richardson, and their descendants all come to mind.

Next came fracking, the process of blasting fluid deep below the earth's surface to stimulate dormant oil and gas wells created an estimated $3.5 trillion in new wealth.

It also made America a major crude exporter for the first time in 50 years and spurred a second wave of natural gas fortunes. Names such as Concho Resources (acquired by ConocoPhillips) and Diamondback Energy (Nasdaq: FANG) soared hundreds of percentage points.

Now, uranium is creating a third energy boom that could be the biggest yet.

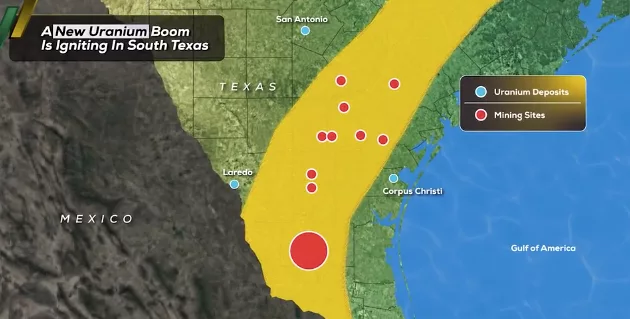

Addison says it all starts with this map:

And the red dots on it represent his #1 stock to play the uranium boom.

The Pitch

All the details on Addison's pick can be found in a new report called “Texas Richer: Our #1 Stock for the U.S. Uranium Boom.”

A subscription to The Grey Swan Investment Fraternity Newsletter is needed to get our hands on it.

This would set us back $49 per quarter (normally $299) and includes “privileges” such as a monthly briefing packed with new insights and investment opportunities, two bonus reports, and access to a group of “outlaw thinkers.” Sign me up.

Texas: The New Global Energy Capital

Addison is convinced that “small, low-impact uranium mines will soon be found throughout South Texas.”

Word is already out about dormant uranium mines coming back online.

But why uranium and why now?

Just like all roads lead to Rome, in the investment newsletter world, all teasers lead to artificial intelligence (AI).

In previous teaser reviews, we already covered how AI cannot develop into Artificial General Intelligence (AGI) or Artificial Superintelligence (ASI) without more energy coming online.

The International Energy Agency's (IEA) latest figures drive this point home.

In its latest market analysis, the IEA forecasts that the growth in U.S. energy demand over the next three years is expected to add the equivalent of California's current power consumption to the national total.

Where will this supply come from?

The IEA says low-emission sources are sufficient to cover growth over the next three years.

However, Texas isn't taking any chances.

The Lone Star State and its Public Utility Commission created an Advanced Nuclear Reactor working group to develop and incentivize the construction of nuclear energy stations, and it's already making progress.

A Bold Plan

At the end of last year, this working group released a roadmap.

One that will “establish an advanced nuclear industry in Texas, solidify its energy dominance, and catalyze unprecedented economic growth.”

But this wasn't just a bureaucratic proposal that would never see the light of day.

Several projects have already broken ground, including one of the first grid-scale Small Modular Reactors (SMR) powering an industrial site in Seadrift, Texas.

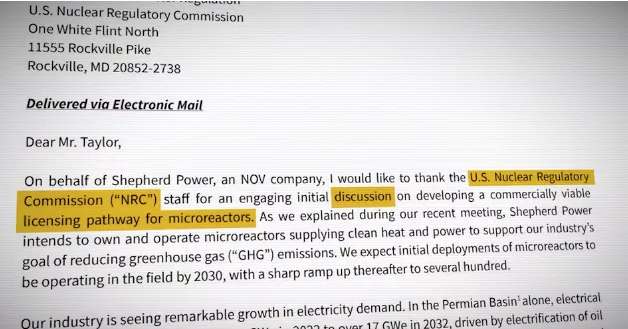

Natura Resources is investing $30 million to build a molten salt SMR in Abilene, Texas. Another company, Shepherd Power, a wholly-owned subsidiary of NOV Inc. (NYSE: NOV), is working on a licensing pathway for microreactors.

All of this is underpinned by the “Silvery-White Metal,” uranium, and one company has the largest licensed production in America.

Revealing Addison Wiggin's #1 Uranium Stock

We got a few clues midway through the video teaser:

- Besides having the largest licensed production, this company controls the largest uranium field in Texas.

- It also owns four similar production sites nearby.

- Finally, it has zero debt and all of its profits are going towards expansion.

This sounds like Uranium Energy Corp. (NYSE: UEC). The clues align like protons and neutrons at the center of an atom.

- UEC has a constructed and licensed uranium capacity of 8.5 million pounds per year across its Wyoming and South Texas platforms, more than any other producer in the U.S.

- The company owns multiple projects in Texas, three in Arizona, and one in New Mexico, which qualify as nearby.

- As per its most recent Q2 2025 report, UEC has no debt on its books, apart from some retirement obligations and deferred tax liabilities.

Get Texas Rich with Uranium?

Solar energy and wind energy may be the fastest-growing energy sources in the world, but uranium is the fastest-growing tangible energy source.

According to the “Red Book”, the uranium industry's bible, “the uranium resource base is sufficient to meet the needs of a high-growth nuclear capacity through 2050 and beyond.”

The caveat is that it will require investment in new exploration and overcoming complex and lengthy regulatory processes in many uranium mining jurisdictions.

On the first score, UEC has an entire pipeline of resource-stage uranium projects throughout the Western Hemisphere.

The second point is a little more contentious. However, when it comes to Texas, the state's main environmental regulator, the Texas Commission on Environmental Quality, has already permitted at least 10 uranium mining sites in South Texas. So it is developer-friendly.

Now that we know it makes sense to own uranium, is UEC the best way to play it?

The macro demand is solidly on its side, the microeconomics (profits) aren't quite there yet, as production hasn't been ramped up.

However, UEC is well-positioned for the future, with more than $200 million in cash, no debt, and more than 1,356,000 lbs. of uranium inventory on hand. It also owns a major equity stake in Uranium Royalty Corp. (Nasdaq: UROY), the only royalty company in the sector.

UEC could be a major producer in the future, and owning it as a speculative play, along with a royalty trust like UROY, and a current blue-chip uranium producer such as BHP or Cameco, makes a lot of sense.

Quick Recap & Conclusion

- Investment newsletter pioneer Addison Wiggin is back, and he's teasing something he calls a “Silvery-White Metal” as the key to getting Texas Richer.

- We learn that “Silvery-White Metal” is code for uranium, and Addison has a #1 stock to play the upcoming uranium boom.

- All the details on Addison's pick can be found in a new report called “Texas Richer: Our #1 Stock for the U.S. Uranium Boom.” A subscription to The Grey Swan Investment Fraternity Newsletter is needed to get our hands on it, and it costs $49 per quarter.

- Fortunately, we were able to reveal the pick for you, for free, it's Uranium Energy Corp. (NYSE: UEC).

- UEC has solid underlying economics, and it is well-positioned to be a major future producer.

Will nuclear energy power AI's growth? Let us know your thoughts in the comments.