Adam O'Dell is teasing a once-every-25-year event in the stock market.

This means capital is flowing into one corner of the market that is bubbling up like a volcano after decades of being dormant, and several “Super Boom Stocks” are about to erupt.

The Teaser

Three economic forces colliding are triggering this rare eruption, which may already be underway…

Adam's LinkedIn describes him as a “Seasoned investment professional specializing in the research, design and implementation of non-discretionary investment strategies.”

This sounds ambigious, but what isn't, is Adam's role at Money & Markets, where he is the editor of several investment and trading newsletters.

These have produced teasers, such as the $5 Stock Sunmit and Tech Titan Stocks – To Make 100x in 6.5 Years, which we have reviewed.

Instantly, there are some clues about the forces at work here, with Adam saying:

The las time such a “Super Boom” happened was 25 years ago, lining investors pockets with $6.5 trillion.

What happened exactly 25 years ago?

The Dot-com boom.

A potent mix of a mix of technological innovation, investment, and speculative fever caused a market melt-up.

So, are these the forces that Adam is talking about?

Perhaps, but at the outset of the presentation, Adam said this is a “once-every-25-year event,” so it may be a decidedly different set of factors.

The End is Better Than The Beginning

Before we get to the good stuff in the video presentation, we are also shown an interesting chart.

It's showing us that the vast majority of gains during the Dot-com bubble happened in the last two years of the boom.

This also applies to Dot-com darlings:

If we missed out on these and others since, now is our chance to make up for it with the biggest super boom of them all.

Adam is confident that certain tech stocks will experience “decades worth of gains” in just the next two years.

It'll be like traveling back to the mid-90s and getting to redo our investment portfolio all over again…

With Adam's “Super Boom Stocks.”

The Pitch

All three are revealed, but only in a report called 3 Super Boom Stocks to Get Your Hands on Today.

To get it, we will need a subscription to the Green Zone Fortunes newsletter which costs $49 upfront for the first year, with a 30-day money-back guarantee.

The 3 Colliding Economic Forces

A massive amount of money is about to hit one corner of the market and it originates from a source that totals $6 trillion.

This is a nod to corporate cash reserves, which exceeded $8 trillion in the first quarter of the year.

This is the first of the three colliding forces and it equates to investment.

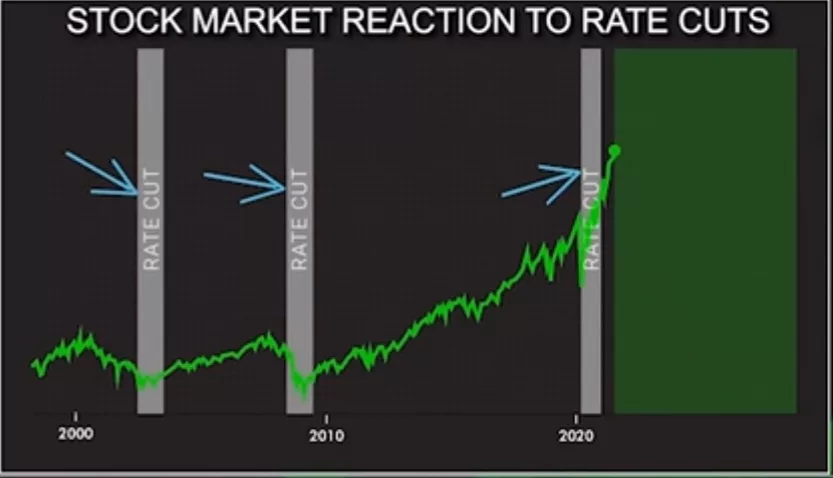

The second is a Fed rate cut, which is the catalyst for investment.

Once the Fed reverses course and embarks on a fresh round of rate cuts, money market fund yields will go down, and stocks will go up.

Adam claims this is “the secret of knowing when to buy stocks.”

Normally, such claims can easily be dismissed as nothing more than hyperbole, but this chart proves our guy has a point:

When this happens again, a good portion of the $8 trillion in cash reserves will flood the market.

The third and final colliding economic force is “the tip of the spear.”

In non-cryptic terms, this means the technology that is driving the most innovation, which today is undoubtedly artificial intelligence (AI).

As time passes the level of technological advancement increases exponentially.

For example, it took more than a century for a public company to hit a $1 trillion market cap, but less than three years for five companies to join the Trillion Dollar Club.

The next wave of trillion dollar companies will take even less time.

Adam believes it won't just be tech stocks in general, but small-cap tech stocks in particular that will make the leap, and he has a few “Super Boom Stocks” that he's recommending.

Revealing Adam O'Dell's Super Boom Stocks

Deep into the presentation, Adam starts dropping hints and naming names.

The first is a free Super Boom Stock pick.

It's name is Opera Ltd. (Nasdaq: OPRA) and it will be a net beneficiary of the upcoming tech stock buying frenzy.

Adam has also found three other stocks that will be big winners in this once-every-25-year boom, starting with…

The Underground AI Chipmaker

- It is based overseas and serves the automotive, medical, aerospace, defense, and mobile markets.

- The company recently signed a partnership agreement for its chips to be used in augmented/virtual reality applications.

A few chipmakers fit this description, including Arm Plc, STMicroelectronics, SK Hynix, but Adam's pick is likely Infineon Technologies AG (OTC: IFNNY).

- Infineon's chips are used by consumer, automotive, and medical manufacturers.

- The company recently expanded its partnership agreement with Namuga, a leading camera module supplier to various sectors, including Augmented Reality/Virtual Reality (AR/VR).

The Underground Circuit Board Designer

- This company designs circuit boards for AI and last year it formed a partnership with Nokia.

Adam's pick here has to be Sanmina Corp. (Nasdaq: SANM).

- Among other products, Sanmina manufactures printed circuit boards for defense, aerospace, medical and other fields.

- It has a manufacturing partnership in place with Nokia.

The Dominator of a Hidden Tech

- This business holds thousands of patents on Linear Resonant Actuators (LRA), which is the technology that makes smartphones a d other wearables vibrate.

- It boasts more than 150 customers worldwide, including Nintendo and Samsung.

Adam's final pick sounds like TDK Corp. (OTC: TTDKY).

- By some counts, TDK holds nearly 60,000 patents in everything from wearable tech to electronic components, and more.

- It works with both Nintendo and Samsung.

Outperform All Index and Mutual Funds?

Warren Buffett's famous $1 million bet comes to mind here.

In 2007, Buffet bet that he could outperform hedge fund managers over the course of a decade by investing in an S&P 500 index fund.

He won the bet in 2017.

I can see a repeat performance for the S&P against O'Dell's picks, but are any a buy on an individual basis?

Opera stock has value at 22x current earnings with a 5% annual yield.

It's growth prospects aren't as good as Infineon's though, which isn't the leader in the AI chip segment, but it will continue to grow due to chip demand from AI data centers, energy infrastructure, and humanoid robots.

At 17x forward earnings, it is a decent pick up.

Sanmina stock is a different story.

As a commodity producer with no visible competitive advantage, paying nearly 26x earnings for the stock isn't something I'm interested in doing.

Finally, TDK had negative free cash flow every year prior to last, which turned around only due to equipment sales to joint venture businesses.

The business is on solid financial footing, with more cash than debt on its balance sheet and a dividend payout ratio of only 33%. However, there are better opportunities to deploy capital into than TDK.

Overall, some solid stock picks that should show steady growth, but they are no “Super Boom Stocks.”

Quick Recap & Conclusion

- Adam O'Dell is teasing a once-every-25-year event in the stock market, that is about to send three “Super Boom Stocks” to the moon.

- The once-every-25-year event is made possible by the three colliding economic forces of technological innovation (AI), investment, and speculative fever.

- Adam has 3 Super Boom Stocks to Get Your Hands on Today and their names and ticker symbols are included in a subscription to his Green Zone Fortunes newsletter, which costs $49 upfront for the first year.

- One pick is revealed for free during the needlessly long video presentation with no playback feature. It's Opera Ltd. (Nasdaq: OPRA), and we were able to reveal the three primary picks for free: Infineon Technologies AG (OTC: IFNNY), Sanmina Corp. (Nasdaq: SANM), and TDK Corp. (OTC: TTDKY).

- The freebie pick (Opera) and the underground AI chipmaker (Infineon) are the best of the bunch in terms of both value and growth.

Is a Fed rate cut already priced into the market? Let us know your thoughts in the comments.