We are reader-supported. This page contains affiliate links, which means I may earn money if you buy something through any link on this page.

After Reviewing Hundreds of Stock Advisories, This Is By Far My Top Pick

Most stock advisories are over-hyped and just plain disappointing.

This is different. Back in 2020, shortly after starting GreenBullResearch.com, I stumbled across a service that I'm still a member of and I can't recommend it enough.

In a nutshell, it's a newsletter advisory service run by professional money managers targeting gains of 3x – 10x+ from heavily discounted stocks that most fund managers would run away from.

What the guys running this stock advisory do is look for out-of-favor sectors that are usually rather unpopular and lack funding.

Because of this, the stocks here are often extremely undervalued and have the potential for big returns – remember they're looking for 3x at a minimum.

This is asymmetric investing >> Investing in stocks that have huge upside potential but low downside.

I'll get into the details on what they look for, why it's low risk, and how they select their stock picks in more detail shortly.

But first, a little about me…

I'm Anders, founder and editor here at Green Bull Research.

I created this website in 2020 to help investors avoid the many overhyped investment opportunities that exist online.

Now, my small team and I help un-tease the teasers, exposing stock picks for free, as well as reviewing the underlying stock advisory services.

Most Investment Advisory Services Are Over-Hyped And Don't Perform Well

This is the conclusion I've come to after reviewing 100's of such advisory services.

There are plenty of these advisory/stock-picking services out there.

The problem is that most of them… well… just aren't that great.

What I've often found is that many of the companies providing such services spend most (or much) of their money hyping up new opportunities rather than finding good investments for their subscribers.

Now I'm certainly not saying that all their services are bad. But, what I am saying is that they are often mass-marketed and hyped-up to no-end… which usually leads to a lot of disappointed subscribers.

The stock advisory I recommend is different.

They take a different approach to things and look for deep value opportunities that few will touch while you'll find most advisory services just recommending the next hottest tech stock and whatnot.

And, well, it works..

Here at Green Bull Research, we like results, not hype.

And this is the point of me writing this today… to go over the only stock advisory service I recommend and why.

It's called the Insider Newsletter, and the professional money managers running it look for stocks most money managers wouldn't touch with a 20-foot pole…

There's a good chance you've never heard of it, and this is likely due to the simple fact that they don't spend much time trying to market their service.

The Insider Newsletter, in summary, is a weekly newsletter advisory service run by professional money manager Chris Macintosh that provides unique market insight & commentary as well as off-the-radar investment ideas that you won't hear 99% of the other “experts” talking about.

Chris' investment approach is generally contrarian, but not always.

The main goal is, of course, to make handsome returns on investments.

How? –> by investing in out-of-favor, extremely undervalued stocks.

He and the team look for sectors that are vital for the functioning of society. So, just because their charts may look like a bloodbath, they aren't going away anytime soon.

This is how they provide asymmetric investment opportunities with little downside risk.

Chris' timing getting into stocks isn't always perfect, but his underlying investment theses tend to be nearly spot-on.

I'll go over this approach with some real examples in more detail shortly, but first let's talk about the guy(s) behind it all more.

Run by professional money managers, not “talking heads” in the media

You won't get any hype from Chris, and this is something I like. He's a no-BS kind of guy, not a professional salesman like many of the “experts” out there.

He's blunt, speaks frank, calls a spade a spade, and covers controversial topics sometimes in very un-“politically correct” ways with much-needed humor at times.

But, I joined this service to make profits, and if this is what you're looking for too then you won't find any better.

Chris Macintosh (the main guy behind it all)

Chris is the main guy here.

He started his career working for investment banks like Lehman Brothers and JP Morgan-Chase, eventually working his way up to managing family offices and investing in venture capital opportunities.

Besides being the founder of Capitalist Exploits (the company behind the Insider Newsletter), he also is the founder of a private money management firm for high-net clients called Glenorchy Capital.

He's well-traveled and has a deep interest in economics and the global geo-political markets, which you will easily be able to see when you read your first Insider Newsletter.

One big benefit that we readers get to enjoy is the fact that someone like Chris has spent decades developing a, from what I can tell, well-informed, “Rolodex” of industry insider contacts that he often uses to get insight into what's going in the markets and the world in general that most people simply don't have access to.

Brad McFadden (behind the scenes)

Chris isn't alone in this work. Behind the scenes, doing a lot of the research and digging around for unpopular stocks that are being traded at massive discounts, is Brad McFadden.

I'm not entirely sure how the two met, but I do know that they've been friends for years and both grew up in South Africa.

Brad has 20+ years of experience in the markets and is the Head Trader at Insider.

You won't hear much from him in the Insider Newsletter, but rest assured he's there helping uncover some of these deep value opportunities that they recommend.

Asymmetric Returns by Investing In Out-Of-Favor Stocks

This is their strategy, and here are a couple of examples of where they invest… at rock bottom…

The first chart shows an investment that took years (right around 4 years) to show any returns worth talking about, yet if you had waited those years you'd be sitting on 4x+ returns… with still a long way to go.

The second chart was more well-timed. They invested right at the bottom, have already made nice returns, and still have a long way to go.

Extremely Undervalued and Out of Favor Stocks

The sectors they look to invest in are often out of favor for political or social reasons and are areas most fund managers wouldn't touch with a 20 ft pole.

Sectors that are out of favor, yet still vital for the functioning of society (this is important!).

What this provides is the unique opportunity to scoop up stocks at bargain prices.

“We’re buying these things when they’re absolute toxic waste”.

Brad McFadden

It's all about asymmetric investing, which is simply finding opportunities with big upside and little downside.

“I engineer my portfolio so that even if I'm right only 25% of the time, I'm still profitable.”

Chris Macintosh

They look for what's profitable, practical, most resilient to the chaos in the world, and… all-in-all, what has the most upside with the least downside.

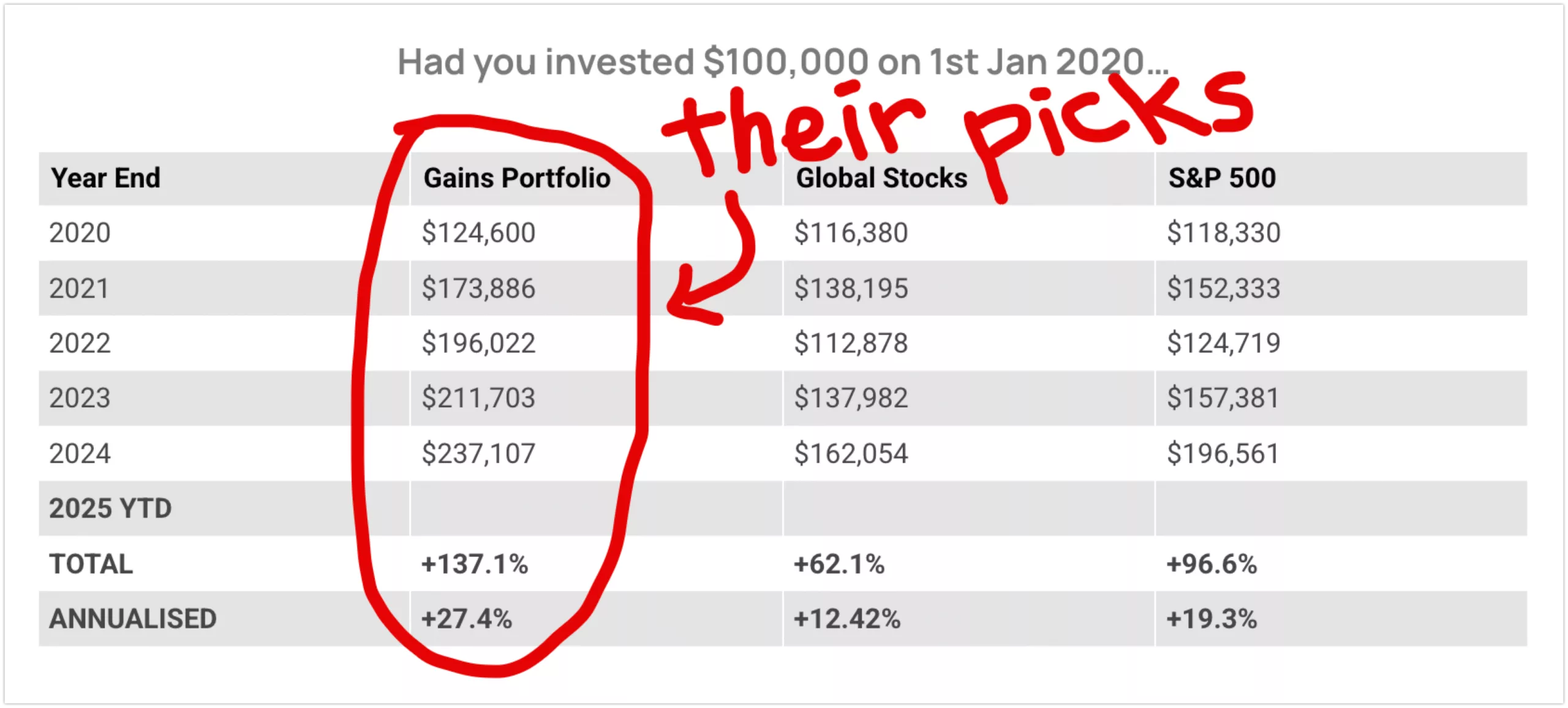

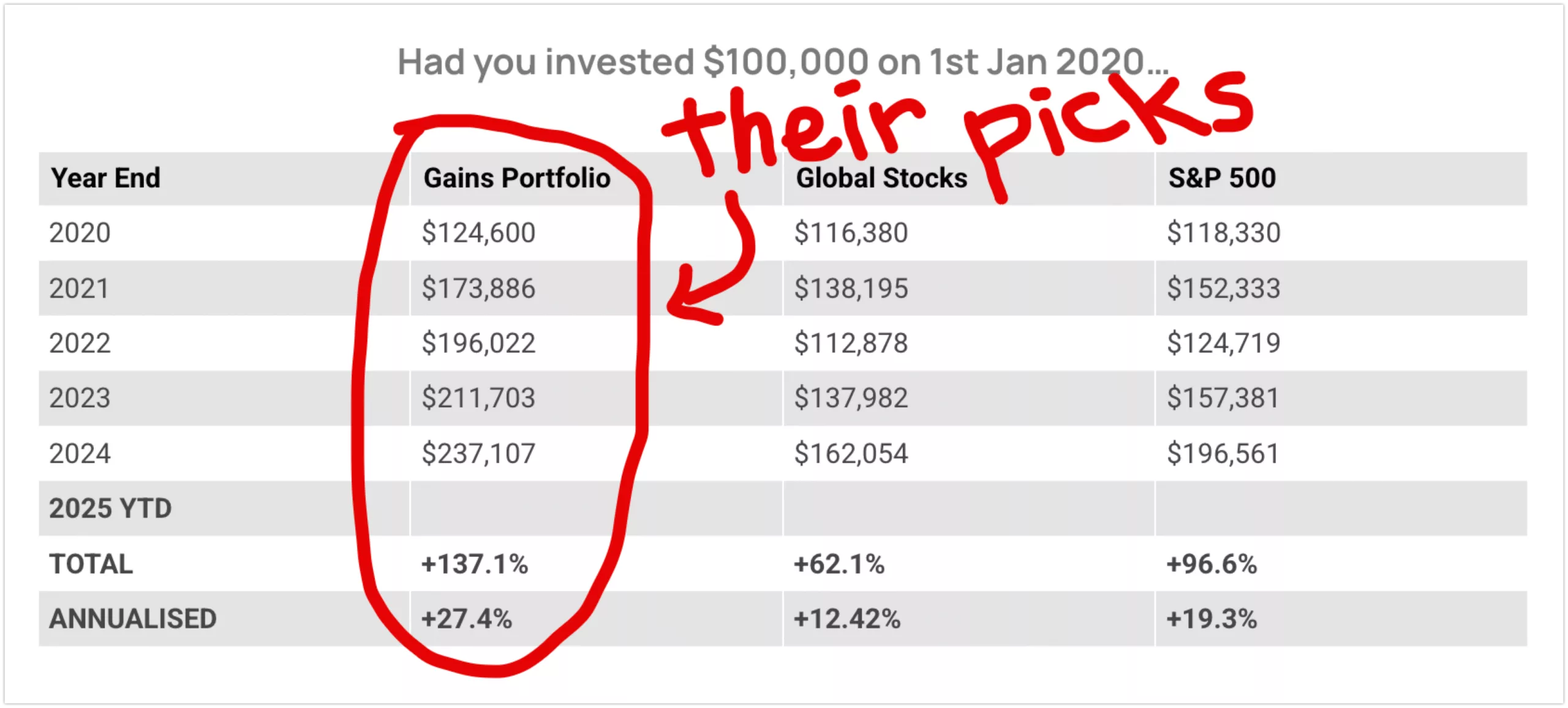

The Results:

Here's a what you're portfolio would look like if you had invested $100k in their picks..

The chart above gives you an idea of what you can expect following their advice and strategy. Luckily, I've been able to experience this firsthand.

And the truth is, much of the potential gains are still to come. Many of their investment theses have yet to fully play out.

As for how they manage to pull off such perfomance, they have a 5-part Investor Series they've put together going over how exactly they find stocks, manage their portfolio, etc. in more detail. Here's an overview of the process (in their own words)…

How They Do It..

They have a 5-part Investor Series where they go over how they target stocks, but I'll give you the basics.

Step 1: First, they look for asymmetric opportunities, meaning areas with lots of potential upside. At the same time, they look to mitigate downside risk, not going for the ‘hot' new trendy stocks that are more speculative.

Step 2: They take a global view and identify sectors where this asymmetry lies. What's going on at a global scale? Where is the money flowing behind the scenes? Rather than single out stocks to invest in right off the bat, they look at entire sectors, “investing in the tide, rather than the boats on it.”

Step 3: Then comes the stock selection, where they go about using stock screening tools and evaluating companies to ensure that they have a small basket of healthy stocks (5-10) representing the sector they're targeting well.

Step 4: When allocating capital to each position, they look to reduce risk by allowing winning positions to run up enough to cover any loses from losing picks.

Step 5: Remember, they're investors, not traders. So there isn't that much action going on when it comes to portfolio management. They monitor their positions and take action when needed, but generally look to hold stocks for ~5 years. So mostly it's a waiting game where you can go about your life as normal.

What you get with the Insider Newsletter

As has become custom, each weekly issue of the newsletter starts with a nice sunset photo or two sent in from subscribers, which of course have nothing to do with investing but are a nice way to start nonetheless.

After this, you'll find a list of what's going to be covered in the current issue and then you'll get to the meat of things, which can be quite a lot of content.

*These newsletters generally seem to range from 20 – 40 pages of unique investment insight, depending on what's going on in the world.

As mentioned, Chris takes a global approach to investing. You can expect a wide-angle macroeconomic view in these newsletters.

Some things you can expect him to cover include:

- Geopolitical events and their effects on markets

- Supply and demand issues, and how we can position ourselves to capitalize on them

- Capital flows in and out of various sectors and what they mean for us as investors

- Talk about inflation, ever-rising state debt, the dying bond market, and how we can profit from the inevitable

Some of the content you'll find here will be a bit glum, but there's not too much doom & gloom because Chris always provides practical solutions to profit.

Finding ways to profit from just about any situation..

Essentially, the Insider Newsletter is a curated report of what Chris and his team, as experienced professional fund managers who have the single goal of profiting from current situations, find to be important enough to share.

No BS.

No hype.

Just the important stuff.

That's the core of the Insider Newsletter.

At the end of each issue, you will find what's called “The Big Five”, which are described as:

"Five interesting long-term setups - unloved and totally off the radar of the average fund manager."

First, you get all the important news of what's going on out there, and then you're left off with some actionable investment ideas.

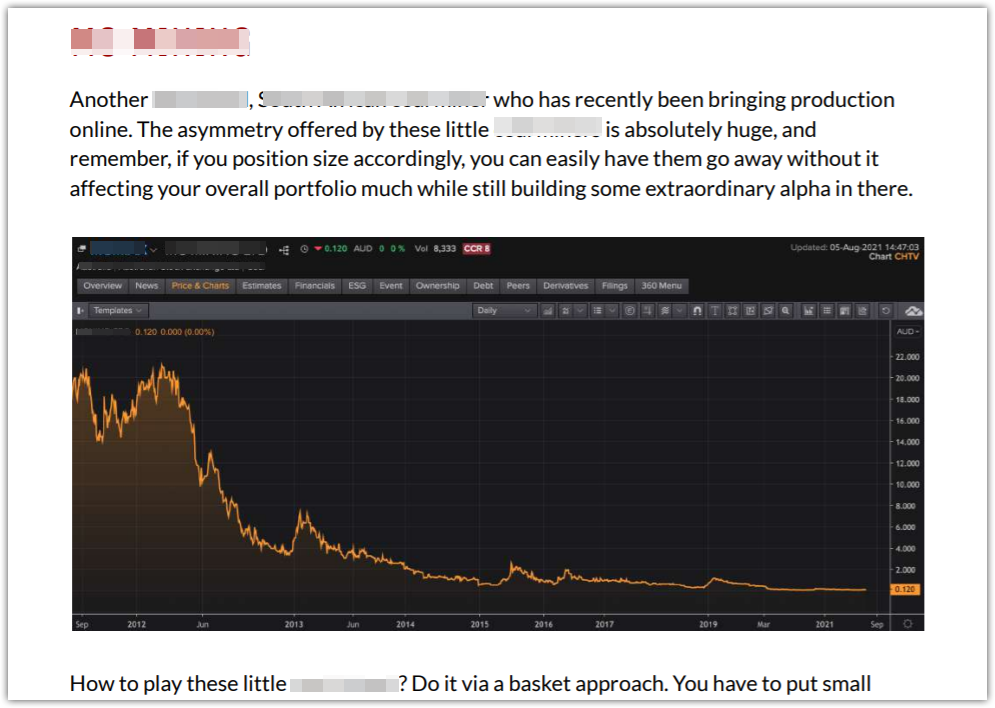

What you'll often find here are charts that offer huge asymmetry, like this one from a recent weekly newsletter…

Remember, they're trying to invest at the bottom.

If You Have a Dollar Then Join!

I can't recommend the Insider Newsletter enough and I hope you can at least somewhat see why from what I've gone over.

It's a breath of fresh air in an industry that is mostly filled with sensationalist garbage.

Keep up to date with what's important and get quality unique investment ideas… for only $1.

This is the special offer that Chris and Brad have made available if you join today.

The Insider Newsletter costs $35 per month, which is one heck of a deal any way you look at it, but right now just $1 for the entire first month.

*Latest issue sent out immediately upon joining.

Why I recommend the Insider Newsletter

I stumbled upon this service pretty much by luck back in September 2020 and it goes without saying that I've been a member ever since (a happy member at that!).

I've reviewed 100s of investment advisory services over the years, many before even starting this website.

Most are heavily marketed, chase the “hottest” new trends, and simply do not perform all that well.

The Inside Newsletter isn't like this at all. It's truly unique in the field.

Chris and Brad take an old-school investment approach.

Sometimes they invest in “boring” things… but nothing is boring about making 3x+ returns.

I'm far from the only person who agrees.

Insider has a 4.9 out of 5-star rating on Trustpilot – almost unheard of when it comes to reviews of investment newsletter services.

There are quite a bit great reviews from truly grateful subscribers.

Here's a review I found from someone claiming they've “been an investor for over 20 years” and that “this is by far the best service” they've come across…

Here's another, this one from a subscriber talking about the uniqueness of the service, stating that it's something “you will simply not find anywhere else”…

That's a statement I'd have to agree with based on my personal experience as well.

And here we have a review mentioning the “no hype, no need for mass marketing” approach. This is another reason I'm more than happy with the service myself.

Just some of the overwhelmingly positive reviews this service has received.

So, if you're looking for my top recommendation here at Green Bull Research, this is it.

Just be warned… Chris isn't known for beating around the bush, nor is he known for being “politically correct”.

He's a professional money manager above everything else.

He's looking to profit, and he calls things as he sees them.

If you are easily offended, this might not be the right service for you.

But, if you give him an open mind and listen to the unique market insights and investment ideas presented, which are often far from what you'll hear in the mainstream media, then you'll be right at home.

You can click the button below to join and they'll send you the latest issue immediately.